Central banks set monetary policy – allowing them to create money out of thin air. Those who are closest or the first to access this newly-created money tend to be the biggest beneficiaries.

This is known as the Cantillon Effect.

And for all the progressive talk about “wealth inequality” in America, the shift off of the gold standard since 1971 has kicked this effect into high gear – not tax policy.

Wealth creation – from being able to access capital to buy assets or start a new business – has been the biggest driver of this inequality, as worker wages have been stagnant at best when adjusted for inflation.

Access to money, makes more money.

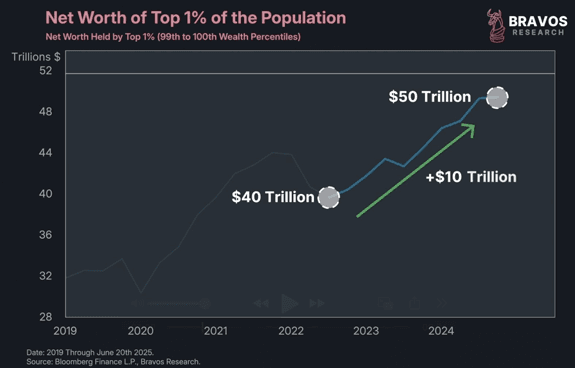

In the last three years alone, thanks to a soaring stock market, the top 1% of Americans has seen their wealth grow by 25%, or $10 trillion:

The systemic wealth transfer isn’t a flaw of fiat money – it’s a feature.

Your best bet to protect yourself? Invest in non-fiat assets, such as gold and bitcoin.

Gold prices are still significantly undervalued in fiat terms. Bitcoin, even with its volatility, offers higher long-term return potential.

“Gold is for protection (and for love),” our friend Frank Holmes likes to say, “Bitcoin is for growth.”

~ Addison

50 Major Companies That Will Likely

|

P.S.: Looking for small-cap companies that are driven by fundamentals and not just retail sentiment? Join our Fraternity!

Each week, we explore more interesting investment ideas, often brought by our contributors and special guests.

For instance, in last week’s Grey Swan Live! with Chris Mayer, we explored some of Chris’s top investment ideas, including some of the best value plays in countries such as Sweden and Poland.

For U.S. investors, tread lightly – these companies can only be bought on the pink sheets, where volume is light and prices can swing wildly. But if you’re looking for value now, going overseas may be just the place to do it.

Meanwhile, you can also join our Portfolio Director Andrew Packer at the Rule Investment Symposium in Boca Raton on July 7-11, 2025. Click here to attend and meet your future cutting-edge resource investments face-to-face.

As always, your reader feedback is welcome: feedback@greyswanfraternity.

How did we get here? Find out in these riveting reads: Demise of the Dollar, Financial Reckoning Day, and Empire of Debt — all three books are now available in their third post-pandemic editions. You might enjoy one or all three.