Here’s some unsettling data.

For the past century, America’s middle class has gotten progressively wealthier, and we enjoy many new technological breakthroughs that can make life easier. Or so you’d think if you believe government statistics.

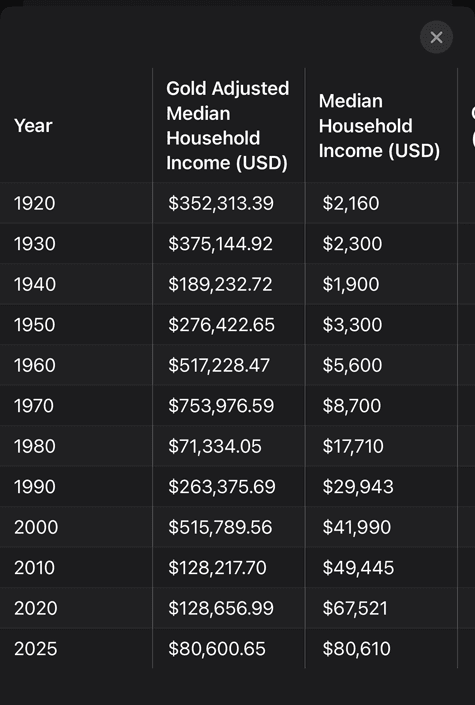

In real terms, the middle class is actually in one of the poorest eras in the nation’s history:

Since 1980, the U.S. government has been tinkering with its inflation calculations.

Did chicken prices soar? Assume customers switched to steak. Are fuel prices high? Make an adjustment for more comfortable cars than your old Buick Skylark.

And on and on and on. They use a technical term known as “hedonic price indexing” to adjust prices you pay.

Measured in gold – a reasonable benchmark against government statistics, “hedonic adjustments” – that sense of unease that you’re not as well off as you think is well, real.

Today, in fiat terms, gold prices are significantly undervalued.

And, it can protect your wealth from fiat’s drop over time… with less volatility than bitcoin.

~ Addison

WARNING:

|

P.S.: Looking for small-cap companies that are driven by fundamentals and not just retail sentiment? Join our Fraternity!

Each week, we explore more interesting investment ideas, often brought by our contributors and special guests.

For instance, in last week’s Grey Swan Live! with Chris Mayer, we explored some of Chris’s top investment ideas, including some of the best value plays in countries such as Sweden and Poland.

For U.S. investors, tread lightly – these companies can only be bought on the pink sheets, where volume is light and prices can swing wildly. But if you’re looking for value now, going overseas may be just the place to do it.

Meanwhile, you can also join our Portfolio Director Andrew Packer at the Rule Investment Symposium in Boca Raton on July 7-11, 2025. Click here to attend and meet your future cutting-edge resource investments face-to-face.

As always, your reader feedback is welcome: feedback@greyswanfraternity.