Oil prices ticked higher overnight — not because demand is booming or OPEC’s cutting supply — but because Israel might start a war.

Such as it is, CNN reports that Tel Aviv could be preparing to strike Iran’s nuclear facilities. The intelligence comes from anonymous U.S. officials, which, these days, is as good as policy.

The market, ever skittish, priced in the risk before anyone made a decision. A few headlines, and suddenly, we’re all short on peace and long on oil.

Just last week, Trump hinted at a new nuclear agreement with Iran. Hope flickered. Then Iran’s chief negotiator showed up with cold water and asked for a “more realistic approach.” Translation: don’t hold your breath.

🛡️Mideast Missile Envy

President Trump has announced a shiny new missile defense system: the “Golden Dome.” Inspired by Israel’s Iron Dome, it promises to intercept ballistic missiles, hypersonics, cruise missiles, and probably bad vibes too.

Trump says it will be “fully operational” by the end of his term. That’s bold, considering much of the tech is still theoretical. He priced it at $175 billion. The Congressional Budget Office took a deeper breath and came up with $542 billion over two decades.

China, naturally, has opinions. A foreign ministry spokeswoman warned it would “shake the international security and arms control systems.” In plain English: “Thanks for starting the next arms race.”

For investors, it’s less about the shield and more about the spending.

Every billion pumped into missile defense flows somewhere — Lockheed, Raytheon, Northrop, even chipmakers like Nvidia. Peace may be the goal, but defense is the business. And it’s a racket, even without a war behind it.

💸 Military Keynesianism: Now With AI

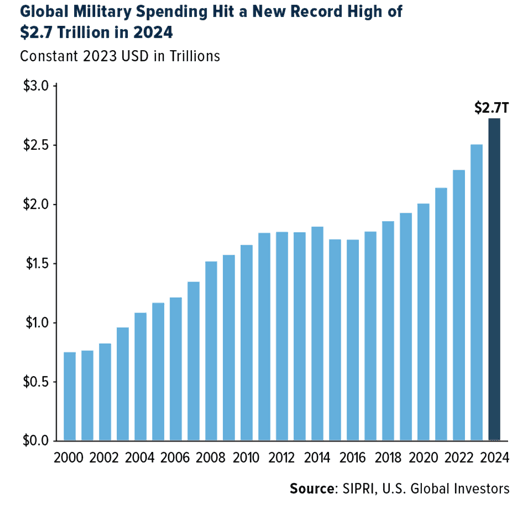

Global defense budgets reached $2.7 trillion in 2024, up 9.4% from the year before — the sharpest increase since the tail end of the Cold War. NATO, unsatisfied with the old 2% target, is pushing for 5% of GDP.

Defense is the new growth sector, pulling in AI, chips, cyber, and aerospace. In a world where everything gets securitized — including public fear — this is the new allocation frontier.

Even Boeing, despite scandal after scandal, is thriving. Forty-five commercial deliveries in April. A record 210 widebody orders from Qatar Airways. The headlines have been brutal, but investors have a short memory when the numbers are good.

📉 The Consumer Confidence Collapse

While the war machine hums, the American consumer is curled up in the fetal position. A Federal Reserve survey shows expectations for personal finances over the next year are at their lowest level ever recorded.

We’re not talking about the aftermath of 2008 or the pandemic. This is worse.

Consumers have never been so pessimistic about their own wallets. Even when unemployment has been at far higher levels.

This matters more than the Fed lets on. If people stop spending, the GDP math breaks. If they start hoarding, the recovery narrative unravels.

For those managing capital, it’s a signal to rethink domestic exposure tied to discretionary spending. The confidence gap is real — and growing.

🛍️ Plans Derailed in the Land of BNPL

Buy now, pay later — turns out it’s the second part people are struggling with.

Klarna, the Swedish fintech giant, reported that consumer credit losses surged to $136 million in Q1, a 17% spike from the previous quarter.

Its revenue rose 15% to $701 million, and the customer base now tops 100 million. Yet 41% of BNPL users are missing payments, up from 34% a year ago.

Nearly one in four are using BNPL to buy groceries — because when your savings run dry, debt picks up the tab.

Klarna insists the bad loans remain “very low” at just over half a percent. But the optics aren’t helping. The company shelved its $15+ billion IPO, citing trade wars and economic instability, and quietly reversed its AI-first customer service pivot by rehiring humans. Apparently, the robots didn’t do refunds well.

Despite winning big contracts with Walmart and DoorDash, Klarna’s story is becoming a case study in what happens when consumer liquidity dies, and tech optimism collides with reality. And the next subprime meltdown won’t be in housing – it’ll be in unpaid trips to your local burrito joint.

💥 The Yield Curve Has a Nosebleed

Another day, another tick up in Treasury yields. The 30-year Treasury yield just climbed back above 5% — the second-highest level in 18 years.

Investors are demanding higher returns just to lend to the U.S. government. That means the cost of servicing America’s $37 trillion in public debt continues to rise — eclipsing even defense spending.

At yesterday’s bond auction, the Federal Reserve ended up buying $50 billion worth of U.S. treasuries to keep the yield as reasonable as possible, as it is creating anxiety over global debt prices.

Another day, another surge in Japanese yields, too: Japan’s 30-year bond yield just hit 3.20%, up 100 basis points since April 7. That’s a 45% jump in just 44 days. At this pace, they’ll be at 4% by June.

🏦 The Next Banking Blow-Up?

Likewise, the regional bank crisis we took an interest in when Silicon Valley Bank (SVB) melted down in a spectacular 48-hour flurry back in March 2023 is still hanging around – and for the same reasons.

Inflation and weak growth are a bad mix for anyone — but they’re poison for banks, especially smaller U.S. lenders still lugging around losses on fixed-rate bond portfolios like an old war injury. Today’s rising yields simply add to that pain, tick by tick higher.

Trump’s trade wars and deficit-heavy budgets are on a path to expose the fragility that never quite healed after the last crisis.

Remember those unrealized losses on Treasurys and mortgage bonds that quietly sparked the collapse of Silicon Valley Bank in 2023? They never left.

As bond yields rise — while recession risk rises too — those losses begin to glow red on balance sheets.

Pair that with souring commercial real estate debt and small-business loan delinquencies, and you’ve got the ingredients for another banking squeeze. Not a contagion. But an opportunity for big banks to swallow the smaller ones.

This time, it won’t be about who’s “too big to fail.” It’ll be who’s too slow to pivot.

— Addison

Grey Swan