Beneath the Surface

The Mainstream Media Will Never Recover From These Shocking Revelations About The Associated Press, The New York Times And Politico

February 7, 2025 • 4 minute, 20 second read

A free and independent press is absolutely essential. In fact, Thomas Jefferson once warned that “our liberty depends on the freedom of the press, and that cannot be limited without being lost.” Sadly, we have just learned that some of our most prominent media outlets have been receiving enormous amounts of money from the government. The New York Times, Politico and the Associated Press were being absolutely showered with money during the Biden administration, and it is no coincidence that their coverage of the Biden administration was extremely favorable. This is a scandal of epic proportions, and there is no way that these media outlets will ever recover from this because their credibility is totally gone.

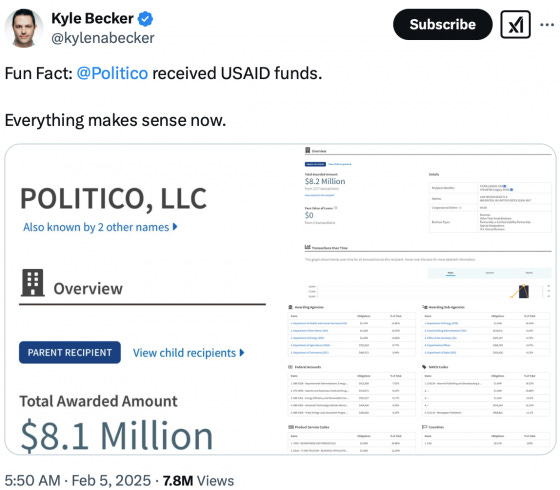

What has been happening at Politico is particularly egregious.

It is supposed to be an independent media entity, but it has been receiving millions of our tax dollars.

In fact, it has received more than 8 million dollars from USAID alone.

But that money from USAID is just the tip of the iceberg.

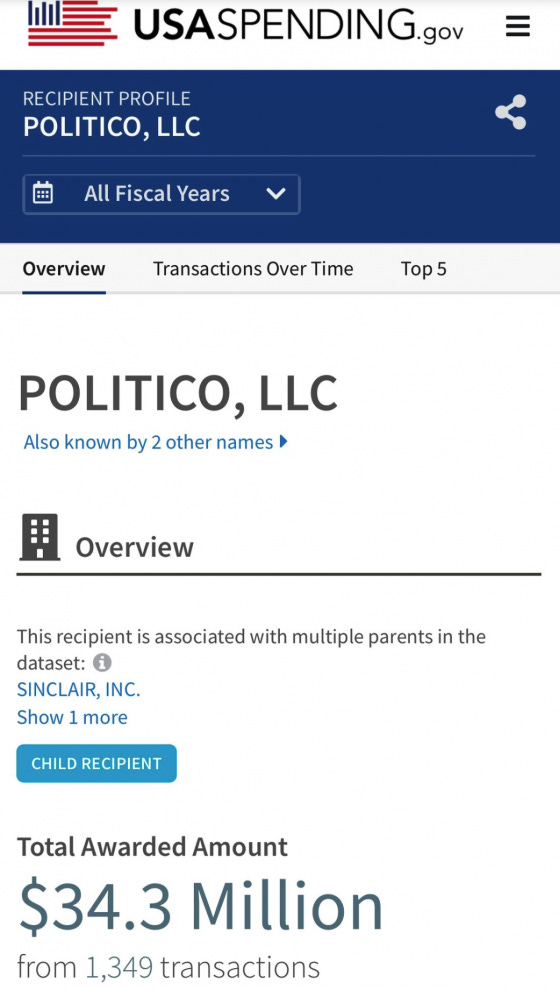

Overall, Politico has received more than 34 million dollars from the federal government.

That is a tremendous amount of money.

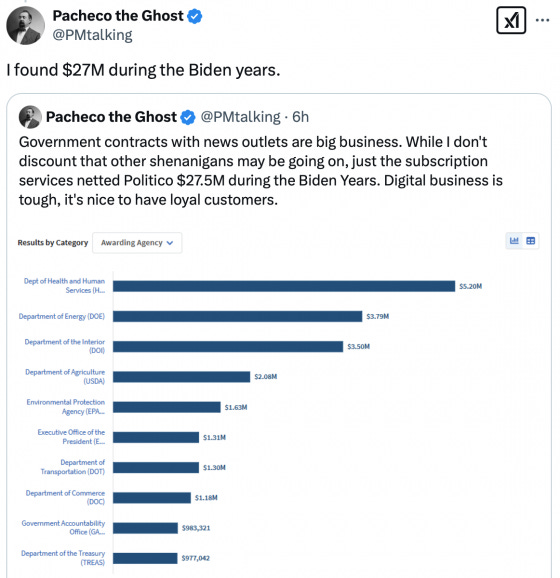

Politico has a subscription option called Politico Pro, and it costs about 10 grand per year.

For some reason, a whole bunch of government agencies were shelling out giant piles of money for such ridiculously-priced subscriptions.

The Biden administration was certainly very good to Politico.

Are we supposed to believe that it was just a “coincidence” that Politico was also very good to the Biden administration?

The following quote from Sean Davis really hit home with me…

It was Politico that maneuvered to have the Hunter laptop story banned and everyone discussing it censored.

Politico peddled the illegal Supreme Court leak that led to the near-assassination of multiple Supreme Court justices.

And now we find out the regime was funneling tens of millions of dollars of our money to Politico?

This is rampant corruption.

Thankfully, the DOGE team is working on ending all payments to Politico right now…

Karoline Leavitt speaks out on USAID spending millions of taxpayer dollars being spent on Politico subscriptions.

“The DOGE team is working on canceling those payments now.”

Interestingly, staffers at Politico “did not get paid for the latest pay period”…

Staff at Politico did not get paid for the latest pay period. The company just sent several emails to employees saying it believes there was a technical error, and is looking into how to fix the issue.

Could it be possible that their staff did not get paid because the gravy train from the federal government is drying up?

Of course Politico is not the only media outlet that has been getting showered with cash.

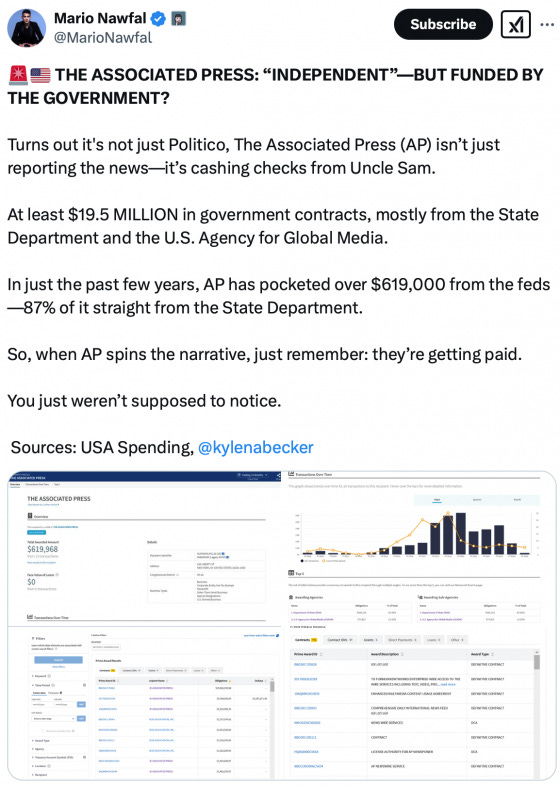

It turns out that the “independent” Associated Press has also been raking in millions of dollars.

How can any organization that has hauled in 19.5 million dollars from the federal government possibly claim to be free and independent?

Someone really needs to ask the Associated Press that question.

But at least the Associated Press has not been as big of an offender as the New York Times has.

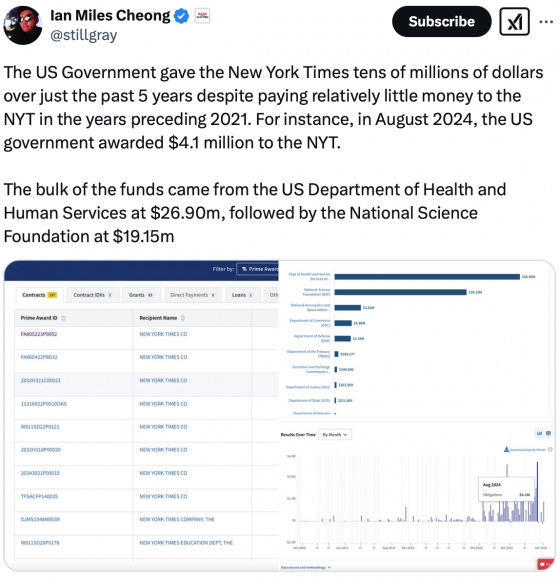

The most important newspaper in the United States has received “tens of millions of dollars over just the past 5 years”.

The New York Times is a complete and utter disgrace.

I am sorry if this offends you, but it is the truth.

Reporters for the New York Times pretend to be “journalists”, but ultimately they are just propaganda mouthpieces.

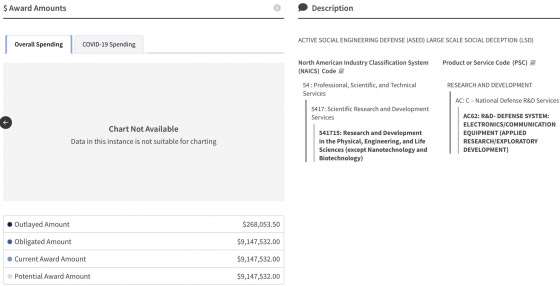

It may not surprise you to learn that Reuters is also corrupt.

In fact, it has just come out that they were awarded a very large government contract for “Active Social Engineering Defense” and “Large Scale Social Deception”.

If you can believe it, Reuters was paid more than 9 million dollars under this single contract.

There is no excuse for any of this.

The good news is that many of these legacy media companies were headed for extinction anyway.

For example, we are being told that “the future of CNN looks grim”…

The future of CNN looks grim as experts say the liberal network is ‘in decline’ after staffers faced pay cuts and a round of layoffs.

Jeff McCall, a communications professor at Indiana’s Depauw University, told the Los Angeles Times that the network’s layoffs are not a good look for CNN.

‘Right now, you think of their brand as in decline. The layoffs; that’s a problem. And it looks really bad when you lose libel suits,’ McCall said.

Because these legacy media companies have lost so much credibility, more people than ever are seeking out alternative sources of information. I am honored to be a part of the alternative media ecosystem, but unlike legacy media outlets I do not receive any money from the government. I am able to keep my work alive by offering books and subscriptions to my newsletter.

Thomas Jefferson clearly understood that “our liberty depends on the freedom of the press”, and the vast majority of our legacy media outlets are no longer free or independent.

So it is up to the alternative media to uncover the truth and keep our leaders accountable, and with your help that is what we will continue to do.