|

Swan Dive — June 5, 2025

The Ghost of Yield Curves Past

Addison Wiggin

Stocks were mixed yesterday, like that bag of caramel and cheddar popcorn no one asked for but always gets opened first at the office party.

The Dow snapped a four-day win streak as investors chewed on disappointing labor data and Trump’s new 50% tariffs on steel and aluminum kicked in like a rusty boot.

Asana tanked after weak forecasts, while Treasurys edged higher thanks to a surprisingly smooth bond auction in Japan.

In Europe, the ECB cut interest rates, again, but trying to project future growth before trade talks with Trump is not a very good use of your time.

Germany’s newly installed Chancellor Friedrich Merz is in Washington for his first face-to-face meeting with the president today. The timing is critical, as 50% tariffs on all European goods are looming.

Wells Fargo’s Parole Wells Fargo’s Parole

After seven years in regulatory purgatory, Wells Fargo finally got the Fed’s green light to remove the $1.95 trillion asset cap slapped on it for its fake accounts scandal.

You may remember the fallout: millions of bogus accounts, a CEO resignation, and the rare feat of being fined by everyone from the CFPB to the Federal Reserve on their way out the door.

CEO Charlie Scharf spent the last six years pulling a “Houdini in a straitjacket” routine — growing the business without actually being allowed to grow the business. Now unshackled, Wells Fargo is scrambling to catch up to JPMorgan, which, just last quarter, made more in trading fees than Wells did in all of 2024.

The G7 Summit isn’t typically a headline-grabber.

But the upcoming summit — beginning on June 15th in Canada — has an air of great urgency, because a major announcement could be forthcoming.

The potential bombshell announcement?

Well, it concerns a classified map of a “secret America” from 1946 — a map whose expanded U.S. borders could go into effect in 2025.

If enacted, this wildly controversial map would grant the federal government astonishing economic, societal, and military power.

But the investment implications could be even bigger.

Click here to view the secret map ASAP >>

Elon’s War on Trump’s Tax Bill Elon’s War on Trump’s Tax Bill

Elon Musk, once a trusted Trump whisperer, is now openly working to kill the president’s prized “big, beautiful” tax bill. The bill would cut taxes by $3.75 trillion — but add $2.4 trillion to the deficit and leave nearly 11 million Americans uninsured, says the CBO.

Republicans are split. Some love the cuts. The smart ones want more.

The latest Fox News whipping boy, the Congressional Budget Office (CBO), isn’t sure how it all plays out, though it did note that Trump’s tariffs might offset the damage… if they don’t start more factory closures first.

Unphased, Trump posted this on Truth Social:

Oy.

More on mounting debt below.

Magnets, Tariffs, and the Great EV Backpedal Magnets, Tariffs, and the Great EV Backpedal

Rare earth magnets: the unsung heroes of electric motors, headlight adjusters, and windshield wipers.

The problem? They mostly come from China — and China stopped exporting them to the U.S. in April.

Now automakers are out of options:

- Revert to outdated motor designs (less efficient, more expensive)

- Ship half-built engines to China, have magnets installed, and bring them back (brilliant logistics, if your goal is irony).

The magnet crunch already forced Ford to shut down a Chicago plant. European part makers are stalling too. This is what happens when policy runs on slogans instead of supply chains.

Hackers Are Now Using Their ‘Customer Service Voice’ Hackers Are Now Using Their ‘Customer Service Voice’

Google’s Threat Intelligence Group revealed that a wave of voice phishing attacks has hit about 20 companies using Salesforce, including some retail giants. The method? A good old-fashioned phone call.

Hackers posed as IT support, tricked employees into installing malware, and then demanded ransoms. Victims include Adidas, Cartier, and Victoria’s Secret. British authorities believe the infamous Com hacking group is involved — yes, the same crew behind the MGM attack in 2023. This time, they brought PowerPoint slides and polite accents.

Chicago’s Next Act (Maybe) Chicago’s Next Act (Maybe)

The Windy City is staggering under $29 billion in debt and $37 billion in unfunded pensions. Property taxes are up, crime remains a headline, and the population isn’t growing.

Yet a glimmer of hope: billionaire Joe Mansueto is building a $650 million stadium to house the Chicago Fire south of downtown. A literal field of dreams, maybe.

Meanwhile, the Peninsula Hotel just cracked the top 10 of La Liste’s best hotels in the world. At least visitors still sleep well, even if bondholders don’t.

The Yield Curve Is Whimpering Again The Yield Curve Is Whimpering Again

The yield curve is re-steepening — not with confidence, but with the cautious resignation of someone cleaning up after a dinner guest spilled red wine on the white rug.

- 10s–2s spread steepened to +52 basis points

- 10Y–3M flattened to +5

- Both metrics just emerged from multi-year inversions

Tariff tiffs and the “big, beautiful bill” aside, this isn’t your garden-variety recovery. It’s a late-cycle shuffle: the Fed pauses, recession whispers beginning to growl, and long-term growth expectations collapse like a folding chair at a tailgate.

The curve is screaming that the slowdown isn’t coming — it’s here.

Meanwhile…

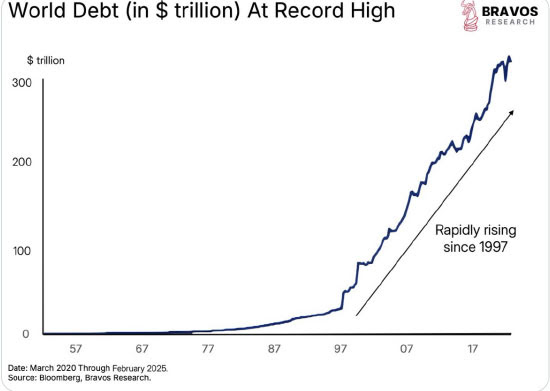

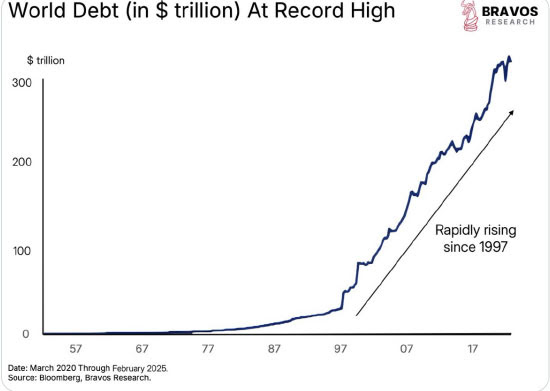

Global Debt Just Crossed $300 Trillion Global Debt Just Crossed $300 Trillion

And it’s still climbing… aggressively.

That number is so large it barely registers anymore. But it should. The last time the world faced a global debt crisis of this magnitude mixed in with a bucket of tariffs and sanctions — back in the 1930s — we got the Great Depression… and World War II.

Now, the same dynamics are in play: sovereign debt piling up with no plan to pay it back, monetary policy stretched to its limits, trade wars, populist crackdowns, and yield curves trying to whisper warnings no one wants to hear.

Suppose you’re managing your own money in this increasingly absurd economic landscape. In that case, it’s always good to remember: when the Fed is fumbling, tariffs are ricocheting, and Elon Musk is opposing his own team, stability isn’t coming from Washington. Or Wall Street. And, frankly, never has.

It comes from the decisions you make.

~ Addison

P.S. Grey Swan Live! with Frank Holmes is coming up at 11 a.m. ET for our paid-up Fraternity members. We’ll talk with Frank about gold, bitcoin – with an emphasis on the mining side given his role at HIVE Digital – and also get into some of the new ETFs he’s helped develop, which help investors buy a basket of some of the next-generation tech trends today – including new defense players.

Your thoughts? Please send them here: addison@greyswanfraternity.com

|

Wells Fargo’s Parole

Wells Fargo’s Parole

Elon’s War on Trump’s Tax Bill

Elon’s War on Trump’s Tax Bill

Magnets, Tariffs, and the Great EV Backpedal

Magnets, Tariffs, and the Great EV Backpedal Hackers Are Now Using Their ‘Customer Service Voice’

Hackers Are Now Using Their ‘Customer Service Voice’ Chicago’s Next Act (Maybe)

Chicago’s Next Act (Maybe) The Yield Curve Is Whimpering Again

The Yield Curve Is Whimpering Again

Global Debt Just Crossed $300 Trillion

Global Debt Just Crossed $300 Trillion