|

Swan Dive — June 4, 2025

The Fake Battle of the Billionaire Banshees

Addison Wiggin

In a plot twist worthy of a Greek tragedy — or at least a Netflix docudrama — Elon Musk is once again the darling of the same online rage brigades that recently applauded vandalism at his dealerships.

Last week, he was palling around with Trump’s advisors. Today, he’s torching the former president’s latest spending bill, calling it a “disgusting abomination” and shaming those who backed it with the online fervor of a man who just discovered shame was still a thing.

The bill barely scraped through the House by a single vote and now limps toward the Senate, where even Trump’s own party is flinching at the price tag. With interest payments devouring a quarter of federal revenue already, the math is starting to look like a Ponzi scheme with better branding.

Here’s what is comically ironic about the left now voicing support for Musk again:

Elon’s lashing out on X… and threatening to primary Republicans who voted for “the big, beautiful bill”… because Congress didn’t go far enough and follow the recommendations DOGE made… the cuts that caused them to torch his dealerships in the first place.

Meet the New QE, Same as the Old QE Meet the New QE, Same as the Old QE

The Fed, that ever-resourceful institution of economic improvisation, is back to buying Treasury bonds — this time under the freshly laundered label of SOMA (System Open Market Account).

Straight out of Huxley. Seriously. You can’t make this stuff up. Soma, if you haven’t read Brave New World since high school, is the “opiate of the masses” – the drug the government uses to promote a peaceful but amoral society.

The acronym might be new, but the playbook is straight out of 2009: flood the market with liquidity, pretend it’s a policy, and pray no one looks at the velocity of money chart.

M2 – a measure of the velocity of money – is on the rise again

The 2008 bailout spree ballooned into a $1.25 trillion asset bonanza within months.

Fast-forward to today: velocity is still in the basement, and the housing market looks more like a repo lot than a place where people raise kids.

This is the part where the Fed pretends to care about price stability… while quietly floating the idea that a little “controlled” inflation might help reduce the real value of the debt. You know, the kind of inflation that wipes out savings but makes government debt look smaller — on paper.

What Donald J. Trump has planned over the next 12 months will reshape America forever… And why it has to happen. The only question for you now: Which side of the RESET will you end up on?

The House of Cards The House of Cards

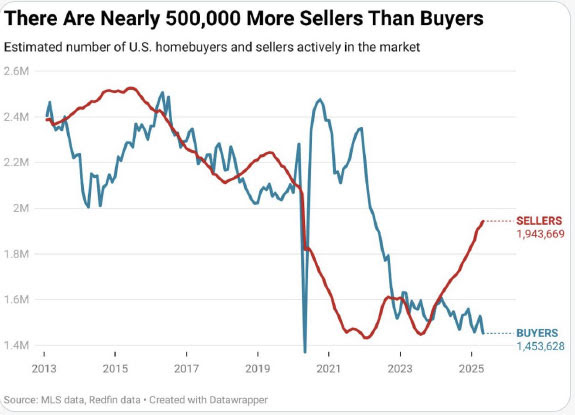

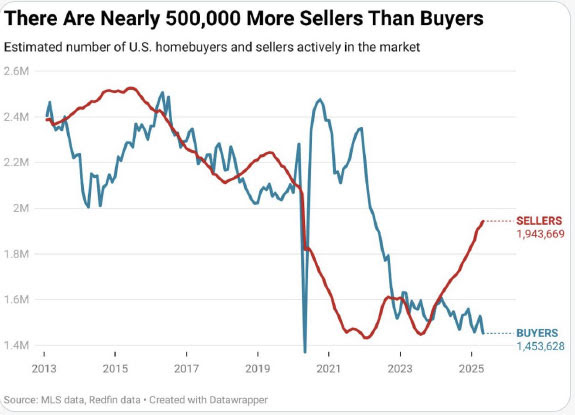

The U.S. housing market has undergone a fundamental shift that can be summed up by one disturbing image: a swelling sea of “For Sale” signs collecting dust in neighborhoods where listings used to vanish in 48 hours.

The 3% mortgage is a relic. Homeowners locked into pandemic-era rates aren’t budging.

Meanwhile, new buyers face the double punch of elevated home prices and 7%+ mortgage rates. The result? Stalemate.

A glut of sellers in the housing market portends lower pricing, on average, nationwide. The obvious caveat applies: all real estate markets are local.

Housing inventory is ticking up, but it’s not the good kind. These are aging listings, boomer downsizers, and overleveraged pandemic flippers hoping to unload before the music stops.

Notice what’s changed? Our money’s on that glut of sellers getting a lot larger over the next one to two years.

That could be a problem if, like the predonmance of the middle class, your home is your largest financial asset and you expect to sell it to finance your retirement.

The OECD Says the Quiet Part Out Loud The OECD Says the Quiet Part Out Loud

Globally, tariffs are starting to take their toll. The Organisation for Economic Co-operation and Development (OECD) just revised its global GDP forecast downward — from 3.1% to 2.9% — and slashed the US outlook from 2.2% to 1.6%.

The culprit? Trump’s trade policy.

“Substantial increases in barriers to trade, tighter financial conditions, weaker business and consumer confidence, and heightened policy uncertainty will all have marked adverse effects on growth prospects if they persist,” they said.

And inflation? It’s coming. We just don’t know how much, or when.

But if you’re trying to manage retirement income, timing is sort of important.

Budget Retailers Are the New Luxury Budget Retailers Are the New Luxury

Dollar General just reported a 5% jump in sales. Campbell’s Soup says Americans are cooking at home more than they have since the pandemic. When condensed broth becomes a bellwether, you know the economy has taken a strange turn.

Higher-income shoppers are raiding the aisles for home décor and discount wreaths.

The CEO of Sam’s Club says, “We do better when things are tough.” Translation: The rich are getting nervous. The poor are just getting hungrier.

Meta Goes Nuclear (Literally) Meta Goes Nuclear (Literally)

Meta is taking the only nuclear option that’s not capping your daily Instagram time at 30 minutes.

Yesterday, the tech giant signed a 20-year electricity deal with Constellation Energy, the largest nuclear power operator in the U.S., as its AI infrastructure guzzles gigawatts like it’s chugging Monster Energy.

Meta won’t actually use the energy. Constellation will deliver it to the grid “on Meta’s behalf,” allowing Zuckerberg’s empire to keep touting carbon neutrality while their AI models continue melting data centers from coast to coast.

The deal also keeps Constellation’s Illinois plant alive past 2027 and allows a 30-megawatt expansion. The market loved it — until it didn’t. Constellation shares popped 9%, then closed slightly in the red.

Nuclear is having a bit of a renaissance:

– Meta aims to add up to four gigawatts of U.S. nuclear generation.

– Microsoft is working to revive Three Mile Island and back experimental fusion.

– Alphabet is dabbling in small modular reactors.

– President Trump just signed four executive orders aimed at quadrupling U.S. nuclear capacity by 2050.

Grandma’s on the Green Grandma’s on the Green

Don’t worry if you left your edibles out. Grandma’s already zooted.

New research shows marijuana use among older Americans surged 46% between 2021 and 2023. As of last year, 7% of Americans aged 65 and older said they’re partaking — up from 4.8% two years prior.

The increase is especially noticeable among senior women, but men still top the charts (some habits die hard).

Doctors aren’t furious — but they’re not handing out bongs, either. They say we still need more research to understand how cannabis interacts with medications and… dignity.

McKinsey’s New Intern Is AI McKinsey’s New Intern Is AI

Following Claude.ai founder Dario’s Amadei’s dire prediction that 50% of white collar jobs have an AI target on their back, the world’s largest consulting firm – and perhaps not ironically, the producers of the most corporate CEOs on the planet – McKinsey & Co., is liberating its junior associates from the sacred ritual of midnight PowerPoint revisions.

The consulting giant is now using a proprietary AI platform called Lilli — named after their first female hire in 1945 — to draft proposals, slides, and even adjust a report’s “Tone of Voice.”

It’s like spellcheck, if spellcheck also made you look smart in front of a Fortune 500 CEO.

According to tech chief Kate Smaje, Lilli is now on every team, and over 75% of employees use it monthly.

“Do we need armies of business analysts creating PowerPoints?” she asked. “No, the technology could do that. Is that a bad thing? No, that’s a great thing.”

Unless, of course, you just got your MBA and a closet full of J.Crew suits.

Last week, a reader forwarded this warning form the founder of Fivver, a cornerstone help wanted website in the online Gig Eocnomy for graphic designers, freelance copywriters. We recently hired doodle-master from Fivver to animate one of our own online skits.

Tiananmen: 36 Years Later Tiananmen: 36 Years Later

Ah well, history rolls on.

On this day in 1989, tanks rolled into Tiananmen Square. Thousands of students were killed or jailed in a brutal display of what a desperate government looks like when it runs out of excuses.

The West was horrified. Sanctions followed.

But history, like bad debt, has a way of circling back.

Today, authoritarianism is more algorithmic. No tanks. Just data collection, narrative management, social credit scores and soft tyranny getting coded into the system all over the globe.

~ Addison

P.S. This morning, we got this nice note from a reader: “Addison, You are the best. I got involved in Metals and Mining back in 1975 and the past 50 years have been quite an education. In my 83 years I have never had this much fun. Keep up the great work that you do.”

Tomorrow on Grey Swan Live! at 11am EST. We’ll beFrank Holmes, CEO of USGlobal Funds – whose background is extensive in the hard asset space, from gold to the digital realm with bitcoin mining. We’ll also be looking under the hood of two intriguing ETFs he launched – JETS and WAR. It’ll be worth your time to tune in and hear Frank’s perspective.

Paid up members: You’ll receive a link by email just prior to the start of GSLive! We’ll see you there!

Your thoughts? Please send them here: addison@greyswanfraternity.com

|

Meet the New QE, Same as the Old QE

Meet the New QE, Same as the Old QE

The House of Cards

The House of Cards

The OECD Says the Quiet Part Out Loud

The OECD Says the Quiet Part Out Loud Budget Retailers Are the New Luxury

Budget Retailers Are the New Luxury Meta Goes Nuclear (Literally)

Meta Goes Nuclear (Literally) Grandma’s on the Green

Grandma’s on the Green McKinsey’s New Intern Is AI

McKinsey’s New Intern Is AI

Tiananmen: 36 Years Later

Tiananmen: 36 Years Later