While Trump’s in the Middle East cutting deals and shaking hands with sheikhs, he’s got the American consumer’s wallet — your wallet — parked squarely on the betting table.

Trump’s roulette diplomacy is entertaining, if nothing else.

The ball’s spinning fast. Dollar dominance? In play. Global trade terms? Up for grabs. Federal solvency? Well… the house is a little over-leveraged and getting even more so.

So, how’s the average American holding up while Trump raises the stakes?

Surprisingly well, actually.

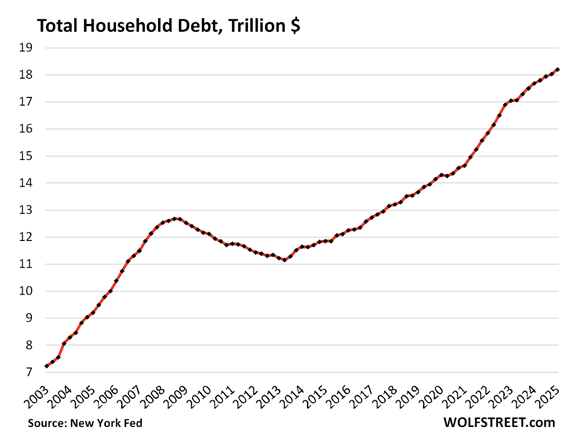

It’s true that total household debt crept up $167 billion in the first quarter to $18.2 trillion — a 1% rise — but disposable income rose faster, up 4% year over year.

That brought the debt-to-income ratio down to 81.9%, which is not only decent but also historically low.

For the first time in what feels like forever, credit card and auto loan balances actually dropped.

Turns out the “drunken sailors” we love to mock might’ve traded in their bar tabs for balance sheets. If only temporarily.

🧨 Subprime Still Can’t Catch a Break

Out at the edge of the credit pool — where the water’s always colder and the lifeguard’s gone home — subprime borrowers are slipping again. Delinquencies are ticking up. Credit scores are heading south. The pandemic-era pause on reality is over, and the default cycle is coming out of hibernation.

Subprime’s not an immediate crisis, but a growing one worth watching.

🎓 Student Loans: Forgiven, Forgotten… Then Oops, Unforgiven

Remember the great student loan pause? Three years of no payments, no interest, and plenty of political promises? Well, that grace period has ended with all the grace of a falling piano.

First quarter student loan balances hit $1.63 trillion.

Of that, $126 billion is now 90+ days delinquent. Remember, these aren’t new loans — they’re just old ghosts that got a court-ordered resuscitation.

💸 The Real Reckless Borrower

Everyone loves wagging fingers at consumers, but let’s be honest: the most irresponsible debtor in the room is still the federal government.

According to Global Markets Investor, we’re already in a debt crisis — we just haven’t sent out the invitations yet.

Seven months into the fiscal year, the deficit is already $1.05 trillion. April brought in a healthy-looking $258 billion surplus — thanks to tax season — but it’s like bailing out the Titanic with a thimble.

The CBO projects a 225% Debt-to-GDP ratio by 2055. That’s assuming no recessions, no wars, no new spending sprees. Sure. Let’s assume that.

📈 The Bond Market’s Tapping the Glass

The 30-year Treasury yield popped to 4.94% — levels we haven’t seen since Lehman Brothers still had a phone line. This isn’t just a market flutter. It’s the bond market flashing hazard lights.

Higher yields mean higher interest costs. And higher interest costs mean that Washington’s room for error just shrank to about the size of a congressional ethics hearing.

🌍 Trump’s New Bretton Woods Moment

Over in Riyadh, Trump is trying to rewire global trade. He’s courting oil producers, cutting side deals, and pitching a return to dollar hegemony like a high-roller laying out chips at a Saudi baccarat table. But behind the scenes, foreign central banks are watching yields and wondering if the dollar’s still the table they want to play at.

Trump wants pricing power back on our shores. But the cost might be an overstretched domestic economy, higher borrowing costs, and a Fed that can’t print its way out this time.

🧠 For the Gentleman Investor Who’s Seen This Movie Before

If you remember Nixon slamming the gold window shut… if you had CDs that paid double-digit interest during Volcker’s inflation smackdown… if you trimmed your tech positions the day Greenspan sighed about “irrational exuberance” — you know what this is.

This isn’t a blip. It’s a regime change. Not just monetary. Fiscal. Political. Global.

The American consumer, somehow, got the memo. They’re pulling back, deleveraging, maybe even saving.

The government? Still out there maxing out the card and calling it “investment.” Trump’s playing for legacy. Powell’s playing for credibility. You, gentle reader, are playing for survival — and if you’re sharp, maybe something better than that. This market rally may be fooling some, but the pain in the bond market suggests more volatility ahead.

~ Addison