~~ Lau Vegys, Doug Casey’s Crisis Investing

The federal government is out of control.

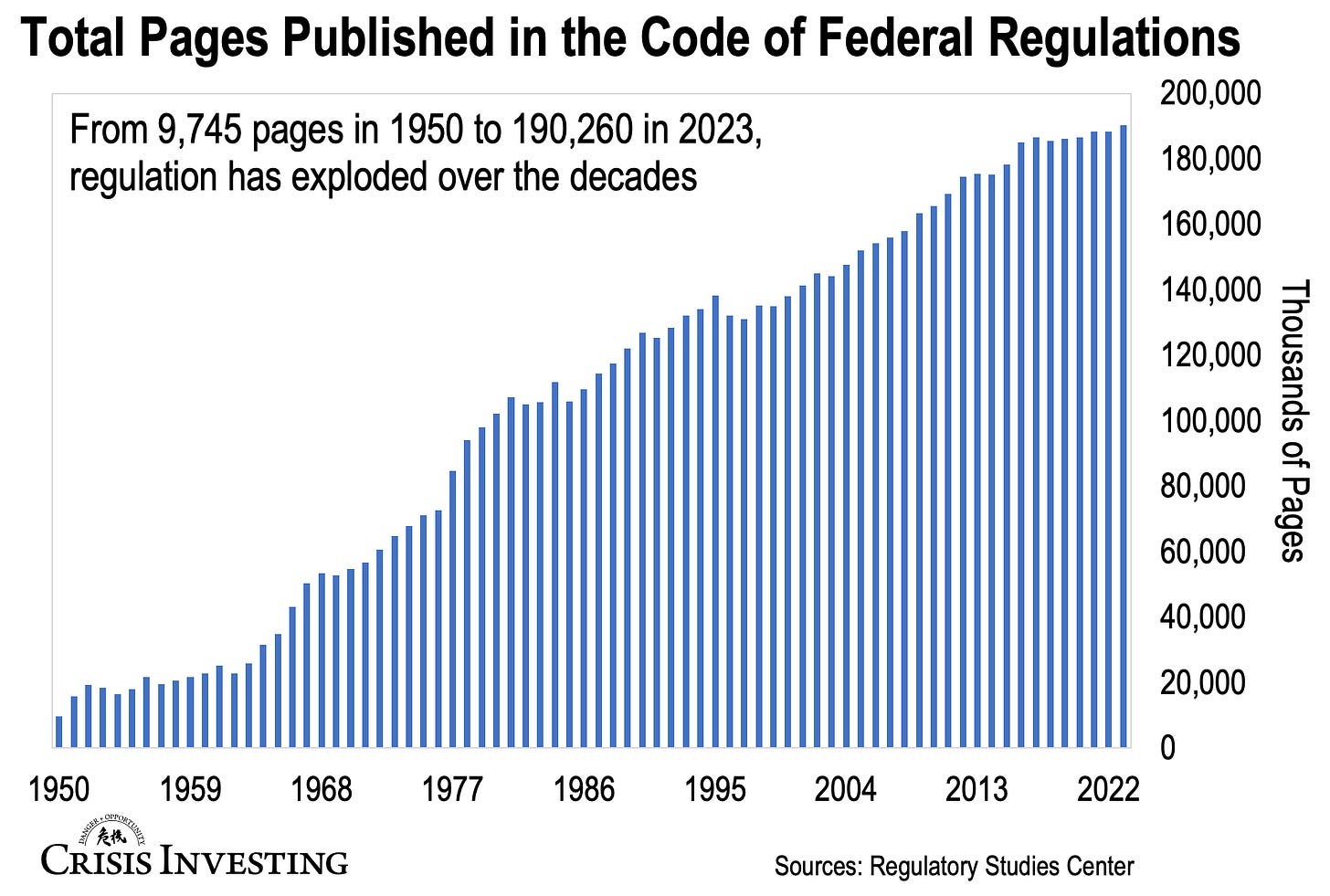

If you’ve been with us for a while, that’s not exactly news to you. But if you ever needed a visual to show someone who doesn’t get it, here’s one. Take a look at this week’s chart below—it shows the relentless growth of federal regulations over the past 70+ years.

This monstrosity has ballooned from under 10,000 pages in 1950 to a staggering 190,260 pages by 2023. That’s thousands upon thousands of pages of rules, dictates, and mandates, crafted by unelected bureaucrats, cramming their tentacles into every nook and cranny of American life and business.

And the costs are staggering. According to a report by the Competitive Enterprise Institute, federal regulations cost the U.S. economy $2.1 trillion per year. That’s an invisible tax of about $15,000 per household. And guess who shoulders this burden? That’s right—the American consumer, worker, and entrepreneur.

Now, if you remember, $2 trillion also happens to be the amount needed to balance the budget today—and it’s the same figure Musk himself claimed he could cut from federal spending through his DOGE initiative (the Department of Government Efficiency).

Of course, as I mentioned in a piece last month, DOGE isn’t an actual government department. It’s just a Federal Advisory Committee with no real power to act directly (except to provide recommendations and advice to the President and federal agencies).

So, as much as I’d love to see a smaller government, a reduced deficit, and a less expensive foreign policy (all desperately needed given the state of U.S. finances), I’m not holding my breath for DOGE to deliver these changes.

Still, whether it succeeds or not, the goal is undeniably noble.

Because this regulatory explosion you see above isn’t just about the economic toll. It’s about lost freedoms, crushed innovation, and the constant distortions it forces on the market. Every new page added to this monster is another blow to liberty, another barrier for hard-working Americans, and another chain on the invisible hand.

Have a great rest of the weekend!

Lau Vegys