In science and technology, progress is linear, marked by trial and error, and innovation is built on “what works.”

In politics, history and love, we humans never seem to learn.

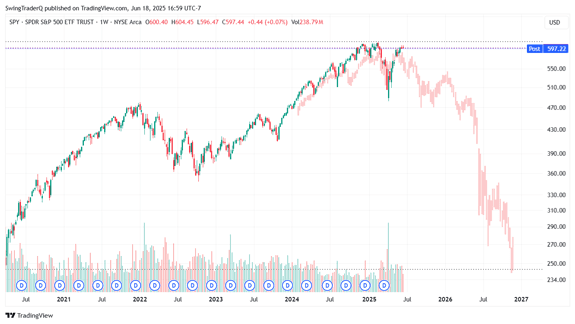

In financial markets, it’s easy to see why people like to say history rhymes.

No matter how sophisticated or automated markets get, they’re still built by humans – meaning they’re built to oscillate between fear and greed, whether they know it or not.

The relentless retail buying we’ve seen in recent weeks feels like greed. But we’ve already had a big selloff and markets at high valuations.

Overlaying the S&P 500 in 2025 with 2008 shows a remarkable similarity so far:

In 2008, the market selloff was driven by a collapsing housing market and an insolvent banking system. In 2025? Who knows, perhaps a revolt against high debt, pushing interest rates higher at a time when they should be moving lower.

Markets are always prone to pullbacks at any time, and for many short-term reasons. But avoiding big losses in a bear market can significantly improve your lifetime investment returns.

It may be time to take a page from Warren Buffett’s playbook by reducing some positions and raising some cash. Given the current yield on cash, that’s not a bad idea. And it’s not too late to add to hard asset positions such as gold and silver.

~ Addison

P.S.: Looking for small-cap companies that are driven by fundamentals and not just retail sentiment? Join our Fraternity!

Each week, we explore more interesting investment ideas, often brought by our contributors and special guests.

For instance, in yesterday’s Grey Swan Live! with Chris Mayer, we explored some of Chris’s top investment ideas, including some of the best value plays in countries such as Sweden and Poland.

For U.S. investors, tread lightly – these companies can only be bought on the pink sheets, where volume is light and prices can swing wildly. But if you’re looking for value now, going overseas may be just the place to do it.

Meanwhile, you can also join our Portfolio Director Andrew Packer at the Rule Investment Symposium in Boca Raton on July 7-11, 2025. Click here to attend and meet your future cutting-edge resource investments face-to-face.

As always, your reader feedback is welcome: feedback@greyswanfraternity.