People are beginning to get gold fever. In the news last week also, came word that one young man had quit his job, loaded up on junior mining shares… and was off for a year of travel. Word is out.

Monday, October 21st, 2024

Bill Bonner, writing today from Baltimore, Maryland:

Bloomberg: “The world’s $100 Trillion Fiscal Time Bomb”

The IMF’s Fiscal Monitor on Wednesday will feature a warning that public debt levels are set to reach $100 trillion this year, driven by China and the US. Managing Director Kristalina Georgieva, in a speech on Thursday, stressed how that mountain of borrowing is weighing on the world.

It seems obvious where this leads. Maybe ‘too obvious.’ Too many people (especially governments) owe too much money they can’t pay back.

But it makes us nervous that so many people are beginning to see things our way. So many are climbing on the ‘inflation’ bandwagon that it’s beginning to feel crowded. And dangerously overloaded. Heck, even the IMF is onboard.

So, let’s backtrack to see if we missed something…

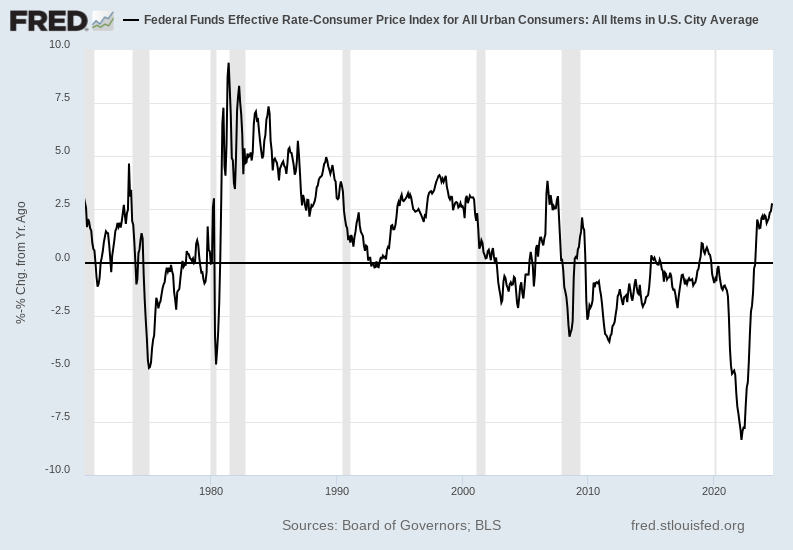

It appeared to us that the bull market in bonds which had begun in 1981 finally came to an end in July 2020, with the yield on the US 10-year Treasury so small you needed a microscope to see it — 0.32%.

In the summer of 2022 inflation hit 9%… which meant that the real yield was MINUS 8.3%. This was so absurd we could barely believe it. And it marked, we believed, the end of the 40-year Primary Trend towards lower and lower interest rates.

The stock market, meanwhile, had rolled over in January of 2022. After three decades of boosting stock prices with lower interest rates, the Fed was now intent on raising rates.

It was obvious that bonds were doomed. And banks that had too many bonds in their vaults — such as Silicon Valley Bank, Signature and First Republic — failed.

The Fed, unable to cut rates to rescue the banks or the stock market, had to stand aside while prices fell. The Washington Post explained:

It was a tough year to make money in the stock market. The S&P 500 peaked on the first trading day of 2022 and never came close to revisiting its high point.The widely used market gauge had its worst year since the 2008 financial crisis. One thing explained stocks’ struggles: After years of easy money, the Federal Reserve began raising interest rates in March to combat inflation and never stopped.

We took this to mean that the new Primary Trend in stocks was also down… as it should be.

This analysis looked airtight until September 2022. Then, the Dow hit a low near 29,000 and bounced. It has been going up ever since.

What’s going on?

Stocks should be in a downtrend. But in fact, they are. It’s just hard to see. Gold has been going up too… and going up more than stocks. So, the real trend for the stock market was down.

As predicted, also, the Fed switched to cutting rates again — as soon as it thought it could get away with it. With so much debt in the economy, and their need to finance and refinance so much debt, the feds need inflation, not deflation.

The Fed signaled a turnaround — from raising rates to cutting them — back in December 2023. Stock buyers and speculators anticipated the change throughout the year and finally celebrated it when it happened in September 2024.

Stock prices rose even further.

But so did gold. The Wall Street Journal:

Gold Prices Hit New Record, Are Set for Even More Gains

Gold futures hit a fresh record as geopolitical tensions simmer and economic uncertainty mounts, and they look set to climb even higher.

Continuous gold futures on the New York Mercantile Exchange rose 0.9% to $2,731.30 a troy ounce in European afternoon trading, having reached as high as $2,732.30 earlier in the session.

People are beginning to get ‘gold fever.’ In the news last week also, came word that one young man had quit his job, loaded up on junior mining shares… and was off for a year of travel. Word is out… ‘even more gains’ lay ahead.

The feds have too much debt. Now, they have to inflate it away. Over the last three years, inflation lightened the load by 20% (based on official inflation numbers).

But simultaneously, America’s debt increased from $29.6 trillion in 2021 to $35.7 today — also by 20%.

In other words, adjusted for inflation (the feds’ numbers), the exercise of the last three years raised prices by 20% for US consumers… but it did not lower the real value of US debt (since the feds continued to add to it).

And what this makes us think is that the feds are going to have to try harder. Prepare for more debt…and more inflation…as the ‘fiscal time bomb’ explodes.

What do you think, Dear Reader… is this ‘too obvious?’

Stay tuned.

Regards,

Bill Bonner