Already, the press… the intellectuals… the greasy ‘policy makers’ are finding reasons to dull the DOGE.

Writing in the Wall Street Journal, Francis Fukuyama gives bad advice to the Musk/Ramaswamy duo:

The solution to our problems does not lie in the wholesale undermining of government but in appropriate regulation.

As we have seen, Reagan was right: the more government you have, the less honest, civilized activity you are left with. The whole purpose of government is to rake off wealth and power from the people who earned them… and shift them over to people who didn’t.

Making this more efficient is beside the point. The only sure way to cut back on the expense of government is to cut back the government itself. Like pruning a fig tree, you’ve got to hack away the limbs, not just pluck off a few leaves.

That’s why Javier Milei held up a chainsaw at his rallies, not a scalpel. He offered to whack off huge parts of the government, not to excise tiny moles or ingrown nails.

The chainsaw technique is the only way to do it. First, because you can’t cut $2 trillion from the most politicized budget in the world with tiny incisions. You need to hack away whole programs, departments, mandates… fast. You don’t have time to argue over every small cut. The only way to do it is to rev up the chainsaw and let the chips fly.

And if you don’t, you’ll be playing the feds’ own game.

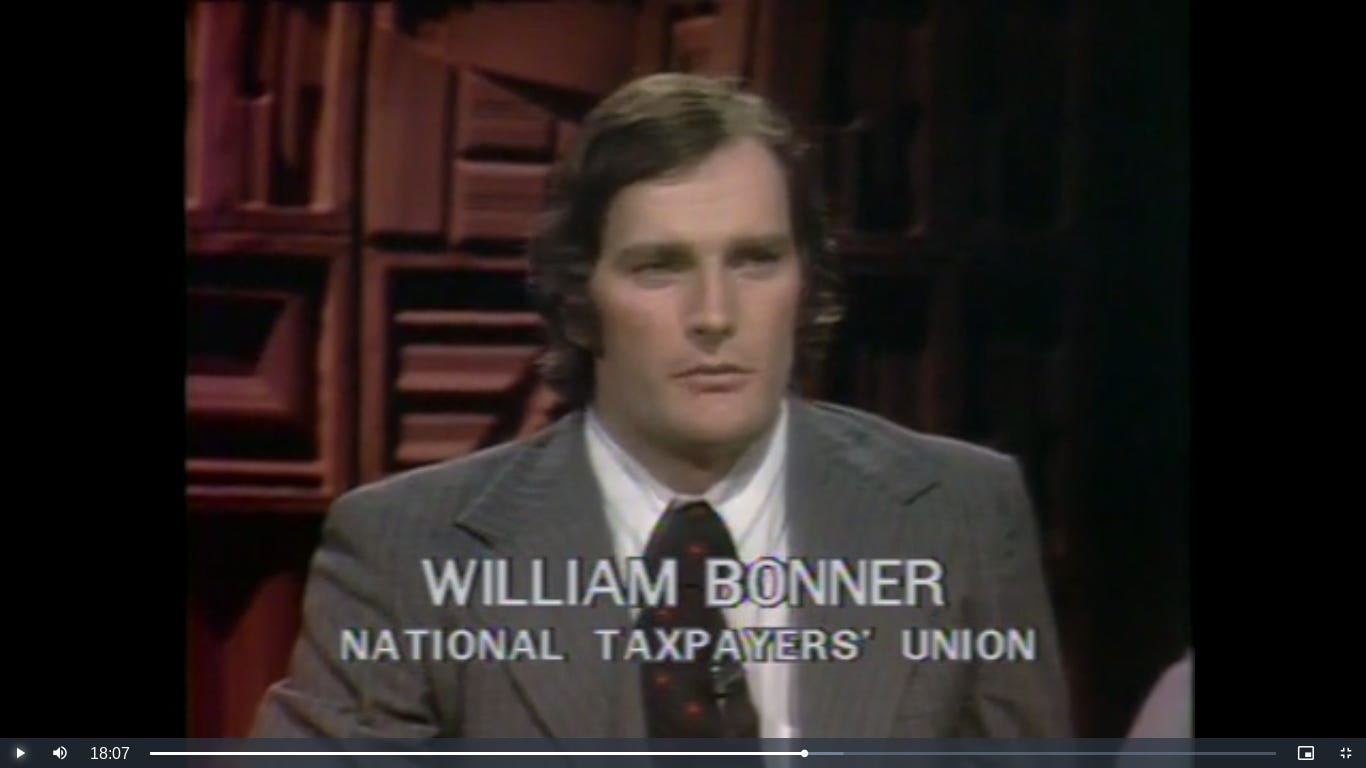

Back in the 1970s, as the very young, very naïve head of the National Taxpayers Union, we proposed cuts to the federal budget to save taxpayers’ money. Then, we were talking about millions, not billions or trillions.

But the feds resisted… frequently complaining that we were proposing an irresponsible ‘meat axe’ approach to federal spending, rather than a ‘carefully detailed program of budget reductions.’

Needless to say, the budget reductions never happened. Because the ‘careful’ approach required further analysis and discussion. Which regulations needed to be updated, revised? What would be the impact? Inter-agency discussions would have to be held. And perhaps existing procedures be streamlined, rather than eliminated? How could policy guidelines be made clearer… less ambiguous… and more easily implemented?

These blabfests — involving endless committee meetings — would take years. And they would require hiring more employees to study the proposals for cutting back on employees!

But Fukayama urges Musk and Ramaswamy to go slowly… carefully… and avoid getting blood on the floor. He isn’t interested in getting rid of government workers, he thinks we need more of them:

‘The federal government doesn’t need fewer bureaucrats; it needs more talented and ambitious ones. Only 7% of the federal workforce is under the age of 30, while 14% are over 60. This is not the right age balance for a government that needs to keep up with the latest changes in technology like artificial intelligence…You are not going to attract smart, creative young people to the civil service if you aim to rule them by fear and arbitrary firings.’

So hang up that meat axe. Put some steaks on the grill and see how many more people you can attract to work for the feds. Fukuyama explains why we need so many:

‘The U.S. is unique among modern liberal democracies in its cultural hostility to government. People in other countries understand that government is necessary to control air traffic, forecast the weather, manage the money supply, regulate food and drugs, police stock markets, train and equip the armed forces and deliver social security checks each month…government performs many critical functions that we take for granted, and Americans will be upset if they wake up one day to discover there aren’t enough bureaucrats around to perform those tasks.’

Really?

Will people be upset if the feds closed some of their 800 overseas military bases?

And what if they didn’t spend so much… didn’t run deficits… and didn’t need to cover the excess with inflation?

Would the shock of stable prices give the economy the heebie-jeebies? Would ‘The People’ really wring their hands in despair if private companies kept their eyes on the weather? And what if investors had to face the truth: that the SEC works for Wall Street, not for them? And the FDA works for Big Pharma, not for consumers? And the whole government looks out for itself…not for ‘The People?’

Our pulse quickens… the horror!

A world without the promise of something-for-nothing… without the Appalachian Regional Commission busily stimulating ‘indigenous arts and crafts,’ or the National Capitol Arts and Cultural Affairs, whose purpose seems to be to provide funds to the Kennedy Center, so the Great and the Good in the Washington DC area can watch operas… subsidized the by the citizens of Cleveland, Sioux Falls, and Albuquerque. A world without AMTRAK…without the F-35….without perpetual war….without $36 trillion in federal debt.

Let the Beltway swamp critters pay for their own damn opera? Let ‘The People’ decide for themselves what foods they will eat…what products they will buy…which car they will buy…and how they will spend their own money?

We shudder at the thought.

Regards,

Bill Bonner