There’s a dirty little secret to earnings season…

Corporate earnings are priced in an asset that isn’t fixed.

Federal Reserve policy and government spending on debt make the U.S. dollar worth less over time.

Sometimes, like right now, the dollar weakens faster than others.

A weaker dollar helps boost sales, exports – you name it. And for companies in the S&P 500, a weak dollar makes the bottom line look good.

On a real, inflation-adjusted basis, however, stocks are pricey.

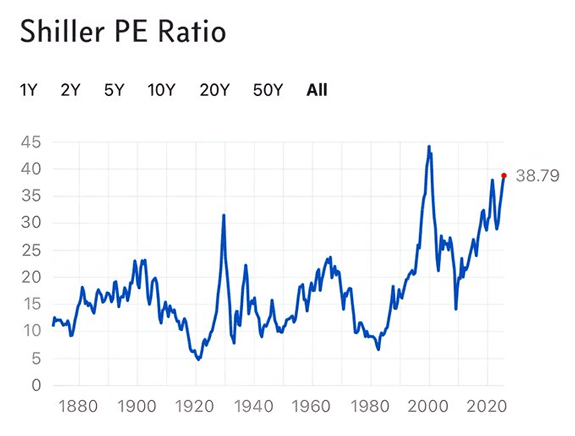

The Shiller Price to Earnings (P/E) ratio looks at earnings over the prior 10 years to determine how stocks are valued.

The current read? It’s a doozy…

Three prior spikes in “valuation”: dotcom bubble, the “nifty fifty” in 1968 and the 1929 crash.

The only other time the Shiller PE ratio has been this high?

The dotcom era. Before that, the go-go market of the 1960s… and before that? The crash in 1929.

As we observed on Grey Swan Live! yesterday with Shad Marquitz, the same bubble mechanics as 1998-2000 are at work today. Nvidia is the new Cisco – with GPUs being the must-own computer component, not routers.

Investors are pricing stocks to perfection… a bright future that will still take decades to build out. Plus ca change, plus c’est le meme chose.

~ Addison

P.S. Also consistent with a bubble: record-high margin debt. And a resurgence in “meme stocks.”

The current earnings season has to be pitch-perfect – or else – we’ll get big price corrections like Tesla Motors and Chipotle Mexican Grill even on very small misses.

If you’ve borrowed to be in this market. Don’t. You’re in a crowded trade. When a trade is crowded, getting to the exit first is on everyone’s mind. Panic now and avoid the rush.

As always, your reader feedback is welcome: feedback@greyswanfraternity.