Five years ago, during the pandemic, the bond market hit record-low yields. At one point, the 10-year U.S. Treasury bond paid a scant 0.318% yield.

Today’s 10-year bond buyers? 4.51%.

For $10,000, that’s a more than ten-fold difference between getting paid $31.80 in annual interest versus $451.

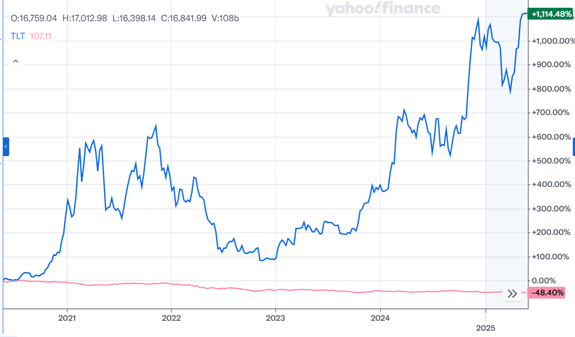

Bonds have been a poor asset, especially longer-dated ones. The iShares 20+ Year Treasury Bond ETF, TLT, is down over 50% since 2020.

Let’s contrast that return with bitcoin.

Over the past five years, whether interest rates have been low or high, whether central banks have been flooding the system or not – bitcoin has soared over 1,100%.

This week, soon-to-retire JPMorgan Chase CEO Jamie Dimon graciously announced that the bank would allow its customers to buy crypto.

That’s after a 1,100% move. And after bonds, which the bank is more than happy to deal in, have been cut in half.

When it comes to crypto, asking a bank about it is like asking a taxi driver what they think of Uber.

There’s a monetary regime change underway. And bitcoin could allow investors to come out ahead – whatever happens – and whoever ends up on top.

~ Addison