You know what the ol’ timers say about history. It rhymes, right?

We’ve been following one particular “rhyme” recently.

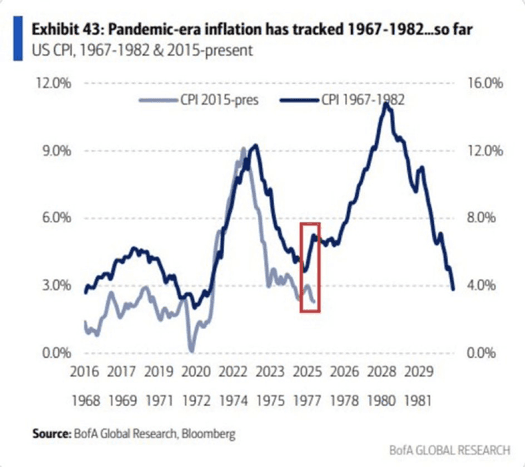

The rise of inflation over the past four years and the prospect for another have been humming along with the same tune as the Great Inflation of the 1968-1980 period.

Right now, the data is showing a small break – in a good way:

The rate of inflation is trending lower.

That’s the good news.

The bad news?

Inflation may be trending lower as consumers pull back, especially on foreign goods with uncertain tariff rates. Tomorrow’s CPI reading and the PPI on Thursday should help shine a light in the dark on tariff price trends.

As trade issues get resolved and if the economy gets moving at a faster rate, inflation pressures may tick up again. As noted in this morning’s Swan Dive – inflation may simply be in what the Fed calls a “pause.”

Gold – stalwart bulwark against inflation since time immemorial – continues to hit all-time highs.

Silver is finally staging a catch-up rally.

Bitcoin – the new kid on the hard asset block – trades at nearly $110,000 today and looks poised to make new highs.

In short, there’s some relief on the inflation front. But only for now.