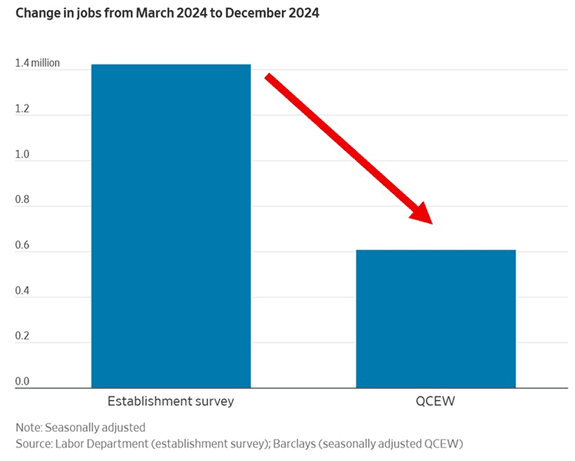

The BLS reported that the number of jobs reported for the 9 months ending December 2024 was likely overstated by ~800,000:

The U.S. government overstated job creation in the last nine months of 2024.

This is the same BLS that printed a massive revision of over 800,000 jobs lower in August of last year, too.

Basic math puts the two revisions at 1.6 million jobs… that were reported but were never created.

That’s bad news – unless you were trying to make the economy look good for some reason in the back half of 2024. (The election, perhaps.)

The new massive revision also suggests that the labor market was in a worse spot when President Trump got back into the big chair.

And… it may even give some credence to Trump’s incessant abuse of Federal Reserve Chair, Jerome Powell. Not enough to cut rates to 1% overnight. But still…

As we observed in our July piece Trump’s Reality Distortion Field, trusting traditional economic data for forecasting rate cuts or an impending recession is a fool’s errand until we can trust the data under review again.

Whenever that may be.

~ Addison

P.S. Part of President Trump’s Great Reset plan is to increase private sector jobs in America. But that trend will also take time to play out. Tariffs play a role, as they make U.S.-based jobs more competitive. But as with all economic changes, it’s like steering a cruise ship, not a jetski – it’ll take time to play out.

As always, your reader feedback is welcome: feedback@greyswanfraternity.