Markets edged higher today — largely on a lack of bad manners rather than news.

U.S.-China trade negotiations continued in London, where Commerce Secretary Howard Lutnick, taking a break from Cantor Fitzgerald, Wall Street’s largest bond dealer, now plays bellicose diplomat and Trump cheerleader.

Lutnick assured reporters the talks were “going well,” which — translated from official-speak — means they haven’t collapsed yet.

Oil prices surged in hopes of a breakthrough, then promptly fell when U.S. officials confirmed that domestic production would decline next year.

It’s a pattern we know well: sentiment up, reality down.

The Great Divergence

The Great Divergence

Retail investors — everyday Americans doing their best to preserve and grow their wealth ahead of endless deficits and persistent inflation — are still buying stocks.

Maybe it’s hope. Maybe it’s the lack of alternatives. Or maybe it’s a belief that someone, somewhere, still has their hands firmly gripped on the wheel.

Meanwhile, institutional capital has been stepping away, on balance, every month of 2025 (with the exception of a surge in hedge fund buying we observed yesterday, on opportunism, we suspect, not conviction.)

Pension funds and family offices are lightening their risk.

Quietly.

Consistently.

“The smart money?” our friends at Global Markets Investor asked this morning. Perhaps. It’s a question worth considering.

Smoke, But No Fire?

Smoke, But No Fire?

We got Consumer Price Index (CPI) numbers this mornin’.

The rate of inflation ticked up a notch in May: 0.2% on the month, 2.4% over the past year.

Core CPI — the version that omits the things you need and actually use — inched its way back toward 3%.

The Fed now faces a dilemma it hoped to avoid: inflation is sticky again as growth slows and jobs numbers get revised downward.

We’re not expecting a rate cut when the Fed meets next week.

In place of rate cuts, we’ll get an increased expectation that Treasury Secretary Scott Bessent — now leading the short list to replace Powell at the Fed next year – will soon be sitting in the big chair at the Eccles Building on 20th Street.

That, and more abuse heaped upon Powell from Trump’s Truth Social account.

The prevailing wisdom on Wall Street is that Bessent will accommodate Trump’s desire for lower rates. Trump wants consumer strength to support his tariff strategy. Bessent may try to give them both — which is a neat trick, if you can pull it off.

But balancing that equation, with rates, tariffs, inflation hanging around, and household credit stretched to historic proportions, is like, well, juggling chainsaws on a seesaw. While chewing gum.

“They Called Me Crazy In 2006.

Then Lehman Collapsed.”

Addison Wiggin’s team predicted the dot.com crash, the 2008 financial meltdown and the housing collapse.

Now he’s come out of retirement to issue his most important warning to date.

He says Trump was deliberately lighting the markets on fire — and it’s all part of a master plan Addison calls THE GREAT RESET.

Most Americans have no idea just how bad this could get… or more importantly why Trump is doing it.

Click here to watch Addison’s urgent message while there is still time to prepare.

“Mostly Peaceful”… and Funded by Whom?

“Mostly Peaceful”… and Funded by Whom?

Riots have returned to the streets of Los Angeles, and so has that magical phrase: “mostly peaceful.”

Like a bad penny or a Fauci press conference, it just keeps coming back.

A mostly peaceful demonstration in the West Village, Lower Manhattan yesterday. The intersectionality of pro-Hamas and anti-ICE protests spreads from L.A. to cities coast-to-coast. (Source: Henry Wiggin)

We’ve been noodling over the intersection between false government data and increased violence from the left since Freddie Gray died and sent mobs into the streets just a mile or so from our house in Baltimore.

In a report we called The Great Shell Game, we posited this idea: people with good jobs don’t throw bricks. Unless, of course, that is their job.

This new wave of “protests” has a curious cast of characters. One day they’re shouting about Gaza, the next about ICE. The overlap between these causes is as thin as their masks. What they do have in common is money, coordination, and media coverage.

So, who’s footing the bill? The list of suspects reads like a cocktail party in Davos: donor-funded NGOs, anonymous endowments, perhaps even foreign governments who benefit from social division and political paralysis. George Soros.

What matters is this: it’s organized. It’s expensive. There’s nothing organic about them. Economic stress always leads to violence – but some folks are putting their well-financed thumb on the scale.

The Debt Grows, But the Jobs Don’t

The Debt Grows, But the Jobs Don’t

Job creation numbers, once the pride of political press releases, are quietly being revised down month after month.

Since January, the Bureau of Labor Statistics has cut over 219,000 jobs from its initial estimates. April alone? Down 30,000.

That means 22 of the last 28 months have shown inflated job data — revised only after headlines move on.

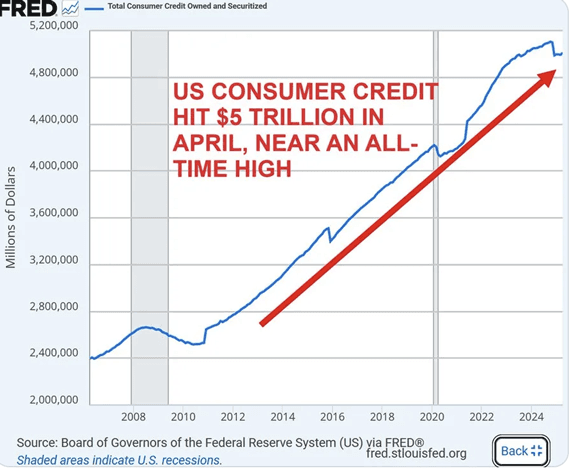

At the same time, consumer debt surged by $17.9 billion in April, pushing total consumer credit to $5.01 trillion. Credit card balances rose by $7.6 billion — the biggest jump since the holiday season of 2023.

Americans aren’t necessarily spending because they feel confident. They are maintaining a proper illusion of middle-class life with plastic, Buy Now Pay Later schemes, and whatever refinancing gimmicks still exist.

Party on.

The Not So Roaring (20)20s

The Not So Roaring (20)20s

Yesterday, the World Bank threw down an equally wet blanket.

The institution cut its global growth forecast for 2025 to 2.3% — the weakest since the 1960s. The U.S. outlook was slashed to 1.4%.

The International Monetary Fund (IMF), not wanting to miss the party, also downgraded global and U.S. forecasts in May.

Even the World Trade Organization (WTO) is forecasting negative growth in global trade. Maybe they’re just eyeing President Trump’s attempts to cut budgets of such multi-national organizations and projecting their fears – but maybe they’re onto something.

Markets Don’t Like Uncertainty. They Despise Deception.

Markets Don’t Like Uncertainty. They Despise Deception.

Bitcoin has held above $100,000 for a month. A technical win, sure — but it says more about faith in the dollar than faith in crypto.

The World Bank just cut its global growth forecast to 2.3%. The IMF dropped U.S. expectations to 1.4%. The WTO forecasts a contraction in global trade.

With each new trade skirmish or data revision, markets are left grasping for a focal point. A predominant narrative. When the numbers are suspect and the trade news shifts daily, capital does what it always does — it retreats to safety. Or worse, it freezes.

That’s when the real damage happens. Not when markets fall… but when confidence vanishes. How long, we ask again, will retail investors hold on and continue to push AI stocks higher?

Private Equity Wants Your Retirement — And It’s Getting Bolder

Private Equity Wants Your Retirement — And It’s Getting Bolder

Private equity giants, hungry for fresh capital, are now targeting retirement savers. Through slick new wrappers like “Private Equity ETFs,” they promise access to elite investments, while delivering opacity, liquidity risk, and a fee structure that would make a medieval tax collector blush.

Moody’s, not exactly known for yelling “fire” in crowded theaters, has already issued warnings. But firms like Apollo, BlackRock, and KKR see opportunity. That $12.5 trillion pool of 401(k) assets? Too tempting to leave untouched. Especially since that’s a pool of capital where investors have been trained to think about the “long-term.”

When the data no longer matches your experience — when prices rise, jobs disappear, and the market climbs anyway — we start to ask more profound questions, right?

Not just about stocks, but about truth. It’s unsettling. Not surprising, really, but disturbing all the same.

The professional class, the “elites” as the pejorative term goes — Wall Street, Capitol Hill, the Fed — still play by their own set of rules.

There’s a chasm between your efforts and their outcomes. You’re trying to preserve what’s yours. They’re trying to preserve their narrative. And they’re willing to print away what you’ve earned – sometimes slowly, sometimes quickly – to do it.

The Cantillon effect still applies… even for MAGA supporters.

The Cantillon effect “describes how the initial impact of new money printed by the government or central bank is unevenly distributed, leading to changes in relative prices.”

In layman’s terms: those closest to the money supply, such as banks, financial institutions, and Wall Street, are the first to benefit from the new money. Everyone else gets higher prices, later.

And in the meantime? A fog of revisions, spin, and distractions.

What happens when that fog lifts?

Markets don’t just correct. They reprice — all at once. And in that moment, those who prepared — who saw through the illusion and moved accordingly — are the ones left standing. Or as the retiring Sage of Omaha once famously quipped: “Only when the tide goes out do you discover who’s been swimming naked.”

~ Addison

P.S. Join us for Grey Swan Live! tomorrow with special guest John Robb. John has been on top of the development of drones for 21st-century warfare – and as attacks by Ukraine against Russian military assets deep behind the frontline of the conflict demonstrate – it’s a powerful trend just getting underway.

We’ll discuss the evolution in drone warfare, other global flashpoints, and tech trends that are shaping warfare today. Our kind of fun weekly conversation – and the kind you won’t hear anywhere else. We’ll see you there.

Your thoughts? Please send them here: addison@greyswanfraternity.com