“ [T]he values to which people cling most stubbornly under inappropriate conditions are those values that were previously the source of their greatest triumphs.”

–Jared Diamond, Collapse

September 25, 2024 – The Fed cut rates by a “shocking” 50 basis points. That much we know.

The move convinced the market, at least, they are dutifully switching policy from the goal of crushing inflation to the second of their dual mandates: supporting the job market.

Today, Grey Swan insider John Rubino, suggests a third motive: goosing activity in the housing market.

Two decades ago, the “wealth effect” was a well-documented part of Ben Bernake’s policy while running the Fed. Keeping interest rates low helps boost the prices of assets like stocks and homes

The fixation with the “wealth effect,” of course, also led to the housing bust and ultimately the global financial crisis of 2008.

Still, if the policy didn’t work the first time, why not double down?

Over the decade following the financial crisis of ‘08, homeowners, at least those who kept their jobs, were able to refinance at historic lows.

In the pandemic era, we all “benefitted.” I’m sure you know of many who refinanced their homes below 3%. We ogle a friend who landed a 15-year fixed rate mortgage at a 1.99% rate.

The historically low mortgage rates held even as inflation crept up over 3% in 2021, effectively allowing homeowners to finance their properties for free in real terms.

Since then, however, the Fed fought bravely against inflation, the overnight rate surged, and mortgage rates zoomed back to over 7%.

What a strange occurrence.

Anyone in the market for a mortgage in the 1970s and even 1980s, 7% would have seemed like a deal. And even at 7%, while they were the highest rates in 15 years, the real rate minus inflation was reasonable.

But, since existing homeowners had become accustomed to low rates, the notion of having to pay real interest above the rate of inflation had become foreign and unthinkable. A whole generation of borrowers had become addicted to low rates.

For those locked into low rates, the desire to maintain “wealth” has kept homes off the market. Home sales over the past two years have occurred slowly and ever-increasing prices. The latest home sale data shows a 5% increase for the prior 12 months ending in July.

For now, unlike the boom times in the early part of this millenium, the housing market has frozen over. And behind the scenes a growing number of homeowners are in all other kinds of financial trouble.

By aggressively cutting rates, the Fed may in fact be taking a page from the Bernanke playbook. As John shows below, things are starting to look ugly for the largest asset most Americans own.

We’re on the sidelines, for now, watching to see if the Fed’s rate cut will be enough to feed the consumer debt habit and unfreeze the housing market. Enjoy ~~ Addison

Watch the Housing Bust Play Out In Real Time

John Rubino, John Rubino’s Substack

Most asset classes have their own unique, repeating cycles. For housing, it usually looks like this:

Demand for homes rises faster than sales, causing prices to increase. Seeing this, would-be sellers hold off to see how much more they can get a year or two hence. Would-be buyers note the rising prices and shrinking supply and succumb to fear of missing out (FOMO), accepting and then pre-emptively topping asking prices (which become the basis for negotiating upward rather than downward). Bidding wars become common.

As prices spike, houses become “unaffordable” — defined as the average person being unable to afford anything remotely like the average house. We entered this territory in 2022 and went deeper into it this year. From a June 2024 New York Times article:

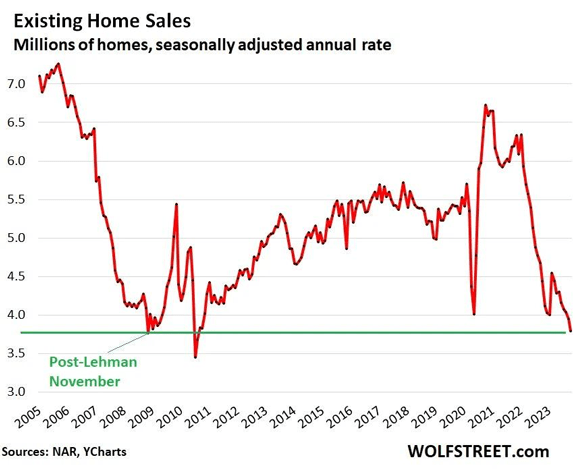

Buyers, now mathematically unable to buy, stop trying. Sellers, unwilling to sell for less than the price someone recently told them their house was worth, delay listing their property in the hope that the frenzy will resume. The number of sales plummets. We are now there:

Enter the Bust

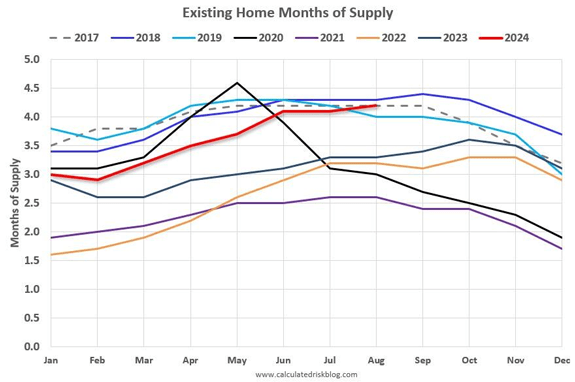

With home prices at record highs and very few actual sales taking place, a growing number of would-be sellers decide to list their properties at current prices, causing the number of houses on the market to rise, both in nominal terms and when compared to the volume of signed deals. The “months of supply” on the market starts to rise. Note the red line depicting the 2024 trend, which has now exceeded all but one year since 2017.

But sales don’t go up because houses at current prices remain unaffordable. Watching their properties languish with no offers and few visits, sellers start to cut prices. By July of 2024, this became a discernable trend:

A new report reveals that sellers are slashing asking prices for their homes to attract buyers as inventory in the market grows.

Nearly one-quarter of home listings (24.5%) got a price cut in June 2024, representing the highest rate during the summer dating back to 2018, according to Zillow’s report.

The real estate company reported that housing inventory is higher this year than in 2023 in all the 50 largest U.S. metropolitan areas except two — New York and Cleveland — and rose month over month in all but five.

“A growing segment of homes that aren’t competitively priced or well marketed are lingering on the market. Sellers are increasingly cutting prices to entice buyers struggling with affordability,” Skylar Olsen, a chief economist for Zillow, said in a company release.

Now For the Great Re-Pricing

To bring this kind of out-of-balance market into equilibrium, one of two things has to happen: Incomes have to rise dramatically, or prices have to fall by at least 20%. The first—higher incomes—is almost inconceivable given record levels of consumer debt and the approaching recession. The second is easier to envision and achieve: Sellers just have to start accepting what the market can offer.

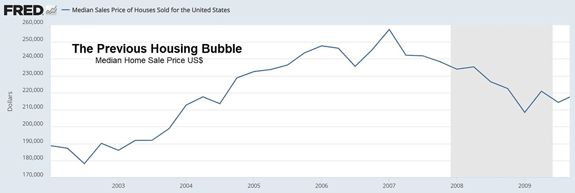

Here’s how that played out in the Great Recession: The median home price fell by about 19%, with much steeper drops in the most overpriced markets.

With houses more overvalued relative to incomes than ever before, price declines at least as dramatic as last time around are possible. And sooner rather than later. ~~ John Rubino, John Rubino’s Substack

So it goes,

Addison Wiggin,

Grey Swan

P.S. Loyal reader Lawrence F. has his own take on the Fed’s aggressive move and what it could mean for markets. He writes us:

“Was the half point reduction in Federal Funds to help the bank to reduce the paper losses on their bond portfolios ? With their commercial loans to the real estate industry? Maybe they know that the derivatives have increased and they have big losses in them? Do they know something that the public doesn’t? The real unknown is will the meeting on October 22nd reduce the usage of the US Dollar in international trade- over time?”

In the pantheon of Grey Swan economic events, a banking crisis ranks high. As we wrote last year (ad nauseum): “In a financial crisis, banks go first.”

Overall, the banking system has managed to weather the high interest rates even booking profits on the spread. But what’s next? What’ll happen when the lower rate cycle takes effect? Thoughts here: addison@greyswanfraternity.com