Beneath the Surface

Silver and Gold: The Week That Could Change Everything

October 23, 2024 • 4 minute, 43 second read

Silver and Gold: The Week That Could Change Everything

$50 silver incoming? What’s next for the precious metals?

This week has the potential to be one of the most significant weeks in the history of money.

36 world leaders, including China’s Xi Jinping, India’s Narendra Modi, and UN Secretary-General António Guterres, are meeting in Kazan, Russia for the BRICS summit. The main agenda of the summit is de-dollarization.

Even The Guardian has noticed. “One of the main aims of the summit,” it says, “will be to speed up ways to reduce the number of dollar transactions, and so mitigate the US ability to use the threat of sanctions to seek to impose its political will.”

I’m not convinced the 36 nations in attendance are quite ready to abandon the dollar, or even make overt declarations of war against it, but for sure we will gain insights as to where we are in the grand scheme of this inevitable move away. We will learn where we are with the alternative payment systems being developed, be it BRICS Pay or mBridge.

The most powerful weapon these nations have against the dollar is gold—far stronger than China’s yuan, or Russia’s rouble, or any other currency basket or crypto amalgam they come up with. Gold is universal money, and its value is understood by all. There has never been a global reserve currency that did not start out backed by gold. How ready these nations are to re-adopt it, we shall soon discover.

In any case, gold has been rallying relentlessly into the de-dollarisation story. We are at $2,740/oz now. Amazing. Perhaps this is a case of ‘buy the rumour, sell the news.’ Whatever. Could be in the short or even medium term. But that’s not the attitude. Owning physical gold is an urgent necessity at the moment. Things are just too precarious. You don’t want to be letting go of long-term core holdings on the basis of potential short-term movements.

I am watching developments closely.

If you are buying gold to protect yourself in these uncertain times, I recommend The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, US, Canada and Europe or you can store your gold with them. More here.

The Silver Surge: Is $50 the Next Stop?

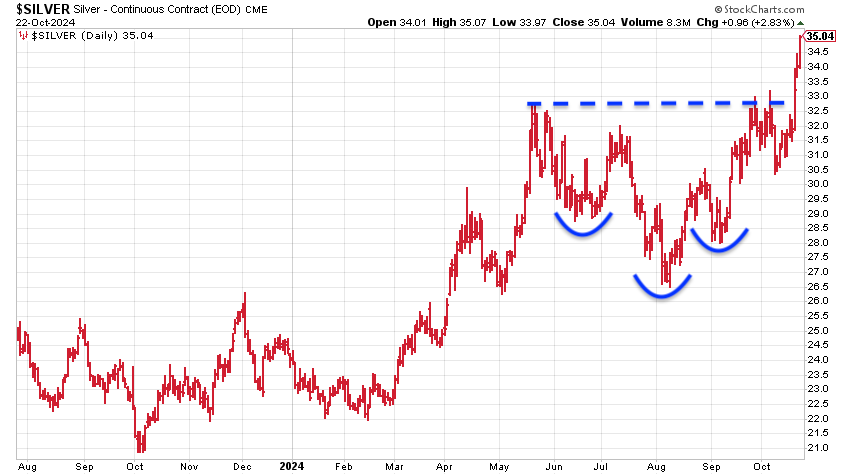

In the meantime, ever unreliable silver has been playing catch-up. It’s gone through all that resistance around $30-33 and has, having done a near-perfect inverted head and shoulders, now broken up to $35. I think it’s going back to $50.

There is some resistance at $35, $37.50, and $44.

You know my views on silver. It’s the metal with the most potential yet, if it can find a way, it will always let you down.

Its natural price is 1/15th of the gold price, because there is only 15 times as much silver in the earth’s crust as there is gold. With gold at $2,700, silver “should” therefore be $180.

In fact, there is a case for silver to be higher than that because, while all the gold that has ever been mined remains, the silver does not—it has been consumed. So above-ground silver stocks do not reflect gold stocks.

The problem is that silver has long since been demonetised. It lost its monetary status when the world adopted gold standards after the various gold rushes in the second half of the 19th century. Without this official backing, silver is only going to be an industrial metal, albeit a precious one.

Gold may no longer be an official medium of exchange, but central banks still buy and hoard it, as do corporations and private investors. The Bank of International Settlements recognises it as a Tier 1 Capital Asset. The same does not apply to silver.

Silver, as we know, also has a multitude of industrial uses, which are only going to increase as the world gets more computerised and electric.

There is also some evidence of silver shortages—over 200 million ounces this year, a similar amount to annual jewellery demand.

Total annual silver demand is around 1.2 billion ounces—the second highest on record. 836 million ounces of that come from new mine supply, 180 million ounces from recycling, and the rest from sales of existing supply.

Demand looks something like this:

- 61% industrial (electrical, electronics, photovoltaics, photography & other)

- 17% Jewellery

- 5% Silverware

- 17% Investment

When silver moves, it moves fast, and it can turn on a sixpence, so it’s important not to get wedded to the silver story. The thing to remember about silver is, like errant girlfriends with personality disorders, if it can let you down, it will. The lovemaking will be unforgettable, you will have the time of your life, but, as sure as eggs are eggs, it will break your heart. Manage your risk.

As I say, there is not a lot standing in the way of silver and $50. In that scenario, the miners will go to the moon.

If it goes to $50, that will only be the third time in silver’s history it made it here—1980 and 2011 being the other two occasions. Third time lucky and all that. If it breaks above $50, there is nothing but blue sky above. Maybe it’ll go to $100 or even $180. It’s a maniacal metal.

Here’s that amazing long-term chart.

How am I playing it?

I may be cynical, but I also think you should always have a position in silver. Its potential is too huge.

I own a silver miner that is just coming into commercial production and therefore due a re-rating. It will make a fortune at $50 silver, but it doesn’t need $50 silver to work.