Beneath the Surface

Preparing for a New Economic Era – Gold in the Age of Trump

January 30, 2025 • 4 minute, 30 second read

Preparing for a New Economic Era – Gold in the Age of Trump

My Outlook for Gold in 2025

Hundreds of tonnes of gold – so much so that there is now something of a shortage in London – have made their way across the Atlantic to the US to get ahead of Trump tariffs. Something like 400 tonnes have gone to the Comex alone, never mind what’s gone to the private vaults of HSBC, JP Morgan et al.

With a shortage of physical gold for delivery in London, waiting times now as long as eight weeks, and the Bank of England refusing to comment, there are all sorts of rumours flying about. It’s not a great situation for London, which is normally the epicentre of the physical gold markets.

I don’t think we’re going to get a proper run on gold, but it’s possible nonetheless, and if we do, talk about unintended consequences…

A bit of zip in the normally quite sleepy physical markets.

Today, however, I wanted to give my outlook on gold for 2025. Before I do this, I have two things to plug:

One is my mate Charlie Morris’ newsletter, Atlas Pulse. This monthly gold report is, in my view, the best out there bar none, and it’s free. More here.

And, two, if you are thinking of buying gold – and I think everyone should own some – my preferred bullion dealer is the Pure Gold Company. You should get your gold or silver from them.

Gold’s Silent Surge

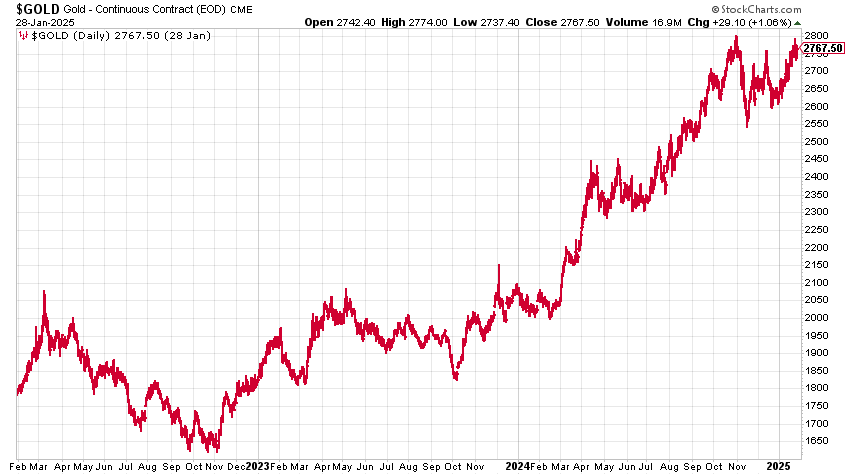

The gold price has been rising relentlessly since November 2022.

Here we are in early 2025, within a few dollars of all-time highs at $2,800.

Gold is at or close to all-time highs against the Japanese yen, the euro, the Swiss franc, the Great British peso, the Aussie and Canadian dollars, and pretty much any other fiat currency you care to mention.

And yet I don’t recall seeing much mention of this anywhere. This is very much a stealth bull market, the best kind of bull market. It means there is plenty more hype left in the can.

Private investors are almost completely ignoring gold. In Germany, normally one of the biggest buyers of physical, I gather we are seeing net selling in the retail markets. One reason is there’s profit to be had, especially for those who bought during Covid – of which there are many . Two, because the economy is in the toilet and people need the money. Higher rates in recent years have dampened both investment and speculative demand for gold.

A lot of the money that fuels the junior end of the mining markets also comes from retail buying, and if they’re not buying bullion, they are certainly not buying miners: hence the atrophy there.

So who is buying then, if the price keeps on going up?

The answer, as regular readers of the Flying Frisby will be able to tell you straight away, is central banks, especially in Asia. This trend accelerating after the US began freezing Russian assets following its invasion of Ukraine.

China imported 124 tonnes just in November, writes Jan Nieuwenhuijs of the Gold Observer. It has bought 1,050 tonnes since the Russian Freeze, and it is buying 400 oz bars from London, which are almost certainly making their way to the People’s Bank of China – 400 oz bars do not trade on the Shanghai Gold Exchange. It is also buying roughly three times as much as it declares.

The explanation is obvious. Central banks need reserve assets which other governments can’t freeze, so-called bearer assets. Gold, which is value in and of itself, is the answer. There is no equal.

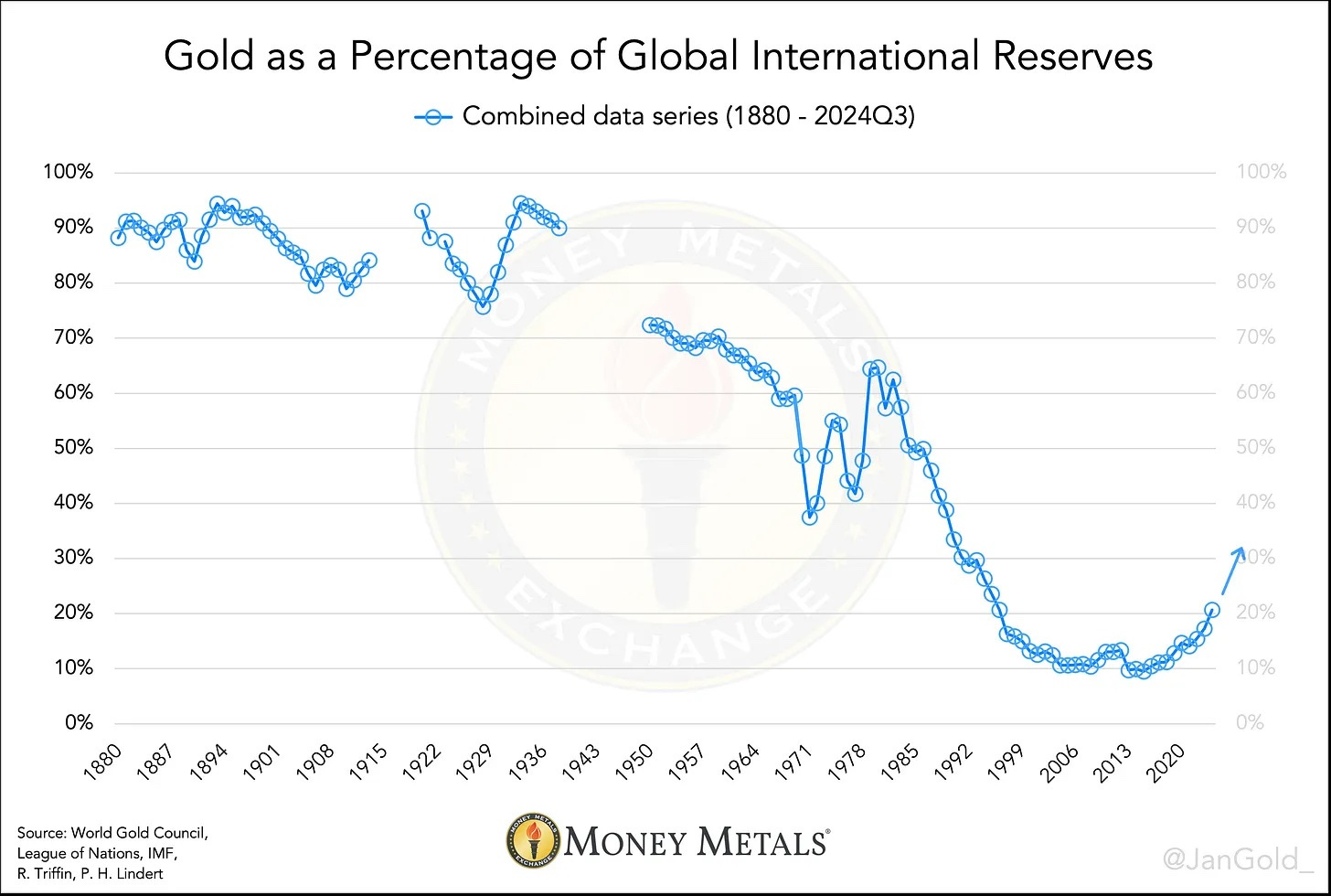

Here we see gold as a percentage of central bank reserves is now at 20%.

I doubt we go back to the heady pre-WWII days when gold made up 80-90% of reserves – money was not fiat then – but you can see the trend is very much up. It has been for 10 years now. The percentage has doubled in that time. I see no reason why it can’t double again in the next ten years. 40 % of reserves held in gold seems like a reasonable number, a conservative number.

Nations are, says Nieuwenhuijs, “obviously preparing for a multipolar world in which the dollar’s role as a reserve asset will be gently reduced.”

You can look at all this and describe the process as natural and sensible asset allocation: diversification away from other government currencies, especially the US dollar.

Or you can proclaim that other nations are preparing to abandon the dollar and for a new gold standard. It’s probably about 80% former and 20% latter. That may well change – but we are not there yet.

While nations might not be so much abandoning the dollar as they are simply increasing their gold holdings, they, are, however, reducing their holdings of US Treasuries. De-dollarisation and diversification.

At the moment, the whole process is covert and benign, but it may become a lot more significant a few years from now.

I urge you too to be diversified and own plenty of gold. It may well be that you are going to need it, and you’re better off booking your seat on the lifeboat now while they are still available. This is especially the case if you are in the UK: there has never been a Labour government that didn’t devalue, and this particular lot are flip-flopping and clueless.