Beneath the Surface

How Much Gold Does China Really Have in 2025?

October 16, 2025 • 6 minute, 47 second read

“If more of us valued food and cheer and song above hoarded gold, it would be a merrier world.”

~ J.R.R. Tolkien

October 16, 2025 — I regard this as one of the most important subjects in geo-politics, which is why I repeatedly come back to it.

It doesn’t matter if you issue the global reserve currency, if you don’t make anything you are in the doo-doo, and this is something the Trump administration is attempting to address with tariffs, a weaker dollar and, more subtly, the managed decline of the U.S. dollar as global reserve currency.

It’s all part of Triffin’s Dilemma. As a result, neutral gold’s role as global reserve asset is re-surging.

History’s “golden” rule will soon apply again: he who has the gold makes the rules. (If you are interested in the origins of the phrase by the way, it’s all here).

This different methodology only came to me overnight, and I don’t know what the conclusion will be yet, though I suspect it will arrive at a figure which is more conservative than what I have argued previously. Here we go.

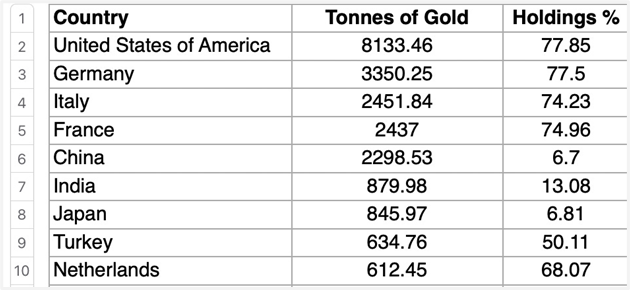

Here, for context, are world central bank holdings, as officially stated.

(Source: World Gold Council)

My argument has long been that China has considerably more than the 2,300 tonnes it says it does.

The People’s Bank of China (PBOC), by the way, is the main custodian, but other state entities, such as China Investment Corporation (the sovereign wealth fund), State Administration of Foreign Exchange and the army, also own gold.

Remember, China is the world’s largest importer of gold, the largest consumer and the largest producer. It’s been that since 2007 when it overtook South Africa.

I am going to use round numbers, as they are more digestible, and when there is a spread — eg 500-1,000 tonnes, take the middle number, ie 750 tonnes.

It is impossible to know just how much gold China has imported, because so many transactions are private, particularly those which go through London, Switzerland or Dubai. The Hong Kong gold is better disclosed.

However, most — though not all — of the gold which goes to China goes through the Shanghai Gold Exchange (SGE). SGE withdrawals from 2007 to mid-2025 total 29,500-30,000 tonnes, based on aggregated data from the Shanghai Gold Exchange (SGE) and World Gold Council (WGC) reports.

However, the SGE is just a flow metric. It does not represent total consumption. Some of that gold which passes through will have been double counted, either as a result of re-selling and re-cycling, or because of China’s booming money-laundering business and the circular trade with Hong Kong.

Estimates for double-counting range from 10% (World Gold Council) to 30% (analyst Koos Jansen). Let’s take the middle 20% figure – 6,000 tonnes – and that leaves us with 23,250 tonnes of SGE gold.

Undisclosed Gold

The PBOC likes 400oz bars, as traded in London, and these do not trade on the SGE, which uses smaller kilo bars, 3kg or 12.5kg bars. 400oz is about 12.4kg, by the way. So a lot of those London imports will not go through the SGE, and so are in addition to the numbers above.

Analysts mostly concur that, while reported imports via London, Switzerland and Dubai total 3,500-4,500 tonnes, another 2,000-3,000 tonnes (mostly post-2009, accelerating since 2022) have gone unreported.

2,500 tonnes is the middle figure, then. Add that to the 23,250 tonnes of SGE and our total is now 25,750 tonnes.

Chinese Gold Production

Around 55% of Chinese gold production is state-owned, and this century, China has mined roughly 7,500 tonnes.

70-80% of Chinese production is sold through the Shanghai Gold Exchange (SGE) — so we have already counted that — the other 20-30% goes to the state.

Using estimates from the mid-range. 25% of those 7,500 tonnes, therefore — 1,875 tonnes — has gone to the state. The rest has been sold through the SGE.

Add 1,875 tonnes to the total and we are at 27,625 tonnes.

By the way, I have not included overseas Chinese gold production, of which there is a lot. Some of this product is sold on international markets and never actually reaches China. But what does reach China gets sold through the SGE and so has already been counted.

Finally, we have to add in gold held in China, whether as bullion or jewelry, prior to 2000. The World Gold Council estimates a figure of 2,500 tonnes in privately-held jewelry. Added to domestic mining and official reserves, you get a figure of around 4,000 tonnes.

This brings our grand total to 31,625 tonnes of gold in China.

Previously, I have argued that 50% of that gold would go to the state. That would mean roughly 16,000 tonnes. Almost twice as much as the U.S.’s reported 8,100 tonnes! When audit?

My thinking has changed.

Cheers,

Dominic Frisby

The Flying Frisby & Grey Swan Investment Fraternity

P.S. from Addison: Sometimes, we get a little obsessed. There’s a new Gemini feature that shows the price action on stock indices, specific stocks, bitcoin, gold and silver updated in real time. The price rolls like an old analog alarm clock. When the price is moving in the right direction, it can be mesmerizing.

We wasted more than a few minutes today watching gold roll its way to new all-time highs, updating each minute. The last we checked, it was $3,408.50. Try it: Just Google “gold price today”— it pops right up.

To recap our research from today’s Dollar 2.0: The Final Countdown: Driven by the unsustainable national debt, policy is supporting a weaker dollar and a move to more viscosity. As in all eras, the national debt needs to be financed with lower interest rates and a weaker currency.

Those are the negative headlines. But what’s unique this time around is the opportunity to digitize dollar assets. It’s only going to happen once.

The dollar isn’t dying; it’s transforming, migrating online. After years of institutional and political headwinds, Trump’s team is monetizing the debt using new technology not previously deployed… and actively blocked by all prior policy.

A fundamental upgrade to the monetary system is underway — one that merges traditional finance with digital infrastructure. Treasury regulations rolling out next week will accelerate that process. As you’ll see in our presentation, there’s a unique one-off meeting happening on October 21, and we expect to set in motion the “final countdown.”

The U.S. dollar and U.S. Treasurys are getting hardcoded into the new digital asset system.

“The tokenization of all assets has begun,” said Larry Fink, BlackRock’s CEO, not as a prediction but as an observation. Banks, fintechs, and blockchain firms are now competing to build the rails of the future — the channels through which every form of capital will flow.

We’re entering a moment when the architecture of money itself is being replaced, layer by layer, while most investors still think they’re trading stocks and bonds in the same system as before.

As we outline in our presentation, up to $20 trillion in assets could migrate into these new digital networks over the next five years — a shift comparable only to the invention of the Internet. Bonds, payments, custody services, commodities — all of them are being reengineered to settle faster, cheaper, and with less friction.

While trading digital coins offers opportunity, understanding the new infrastructure being built beneath them is a better long-term investment.

The AI trade that looked unstoppable a month ago has gone soft at the edges. The dollar’s brief rally feels brittle. Bitcoin’s volatility reminds us how faith-based new money still is. And quietly, the timeless refuges — gold and silver — are catching a bid.

They’re not symbols of “fear” exactly. They’re monetary muscle memory.

That’s why we’re focused on forecasting and positioning — not prediction. The world is moving fast. Markets are emotional. Policy is reactive. But understanding the structure of money, of confidence, of capital — lets you move with the current, not against it.

Gold at $4,200 isn’t a mania. Silver above $50 isn’t panic. They’re the visible signs of invisible motion — the weight of trust sliding down the pyramid. Check out the Dollar 2.0: The Final Countdown replay, right here.