Beneath the Surface

Credit Card Default Wave Hits U.S. Banks

January 14, 2025 • 3 minute, 19 second read

As I’ve said many times in these pages, the U.S. government isn’t the only one drowning in a sea of debt—Americans are too. And nowhere is this more evident than with credit card debt.

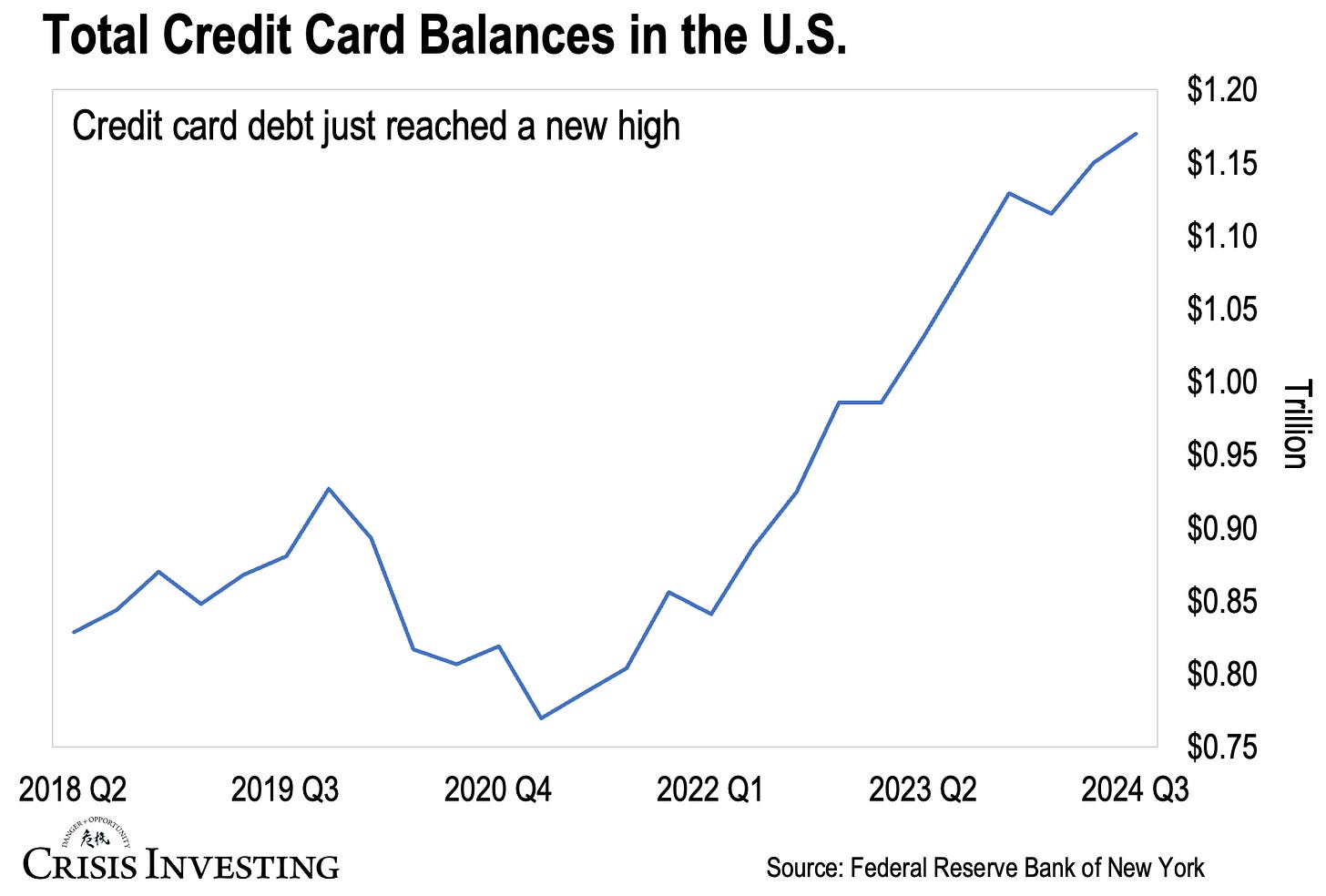

Recent data from the latest consumer debt report by the Federal Reserve Bank of New York shows that credit card balances hit $1.17 trillion in the third quarter of 2024.

This is the highest balance on record since 1947. As you can see in the graph below, credit card debt surged during the pandemic and has continued climbing ever since—all under the watchful eyes of Biden and Powell.

As one reader once pointed out somewhere in the comments section, card balances aren’t that important if we pay them off at the end of each month—and what we should really be watching are delinquencies.

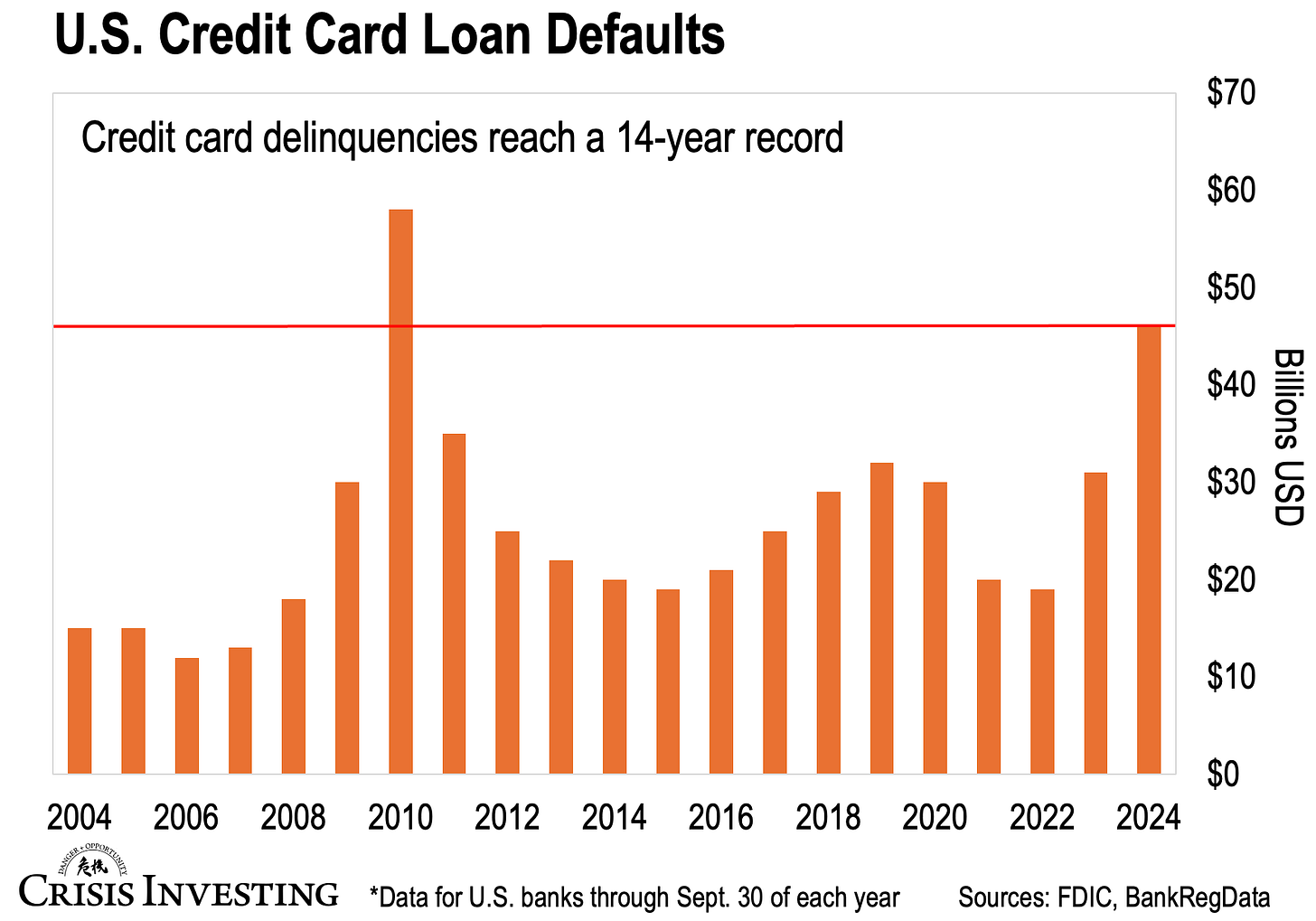

While that might be the case (with a few caveats), I’ve got some bad news for you. New data is in… And as it turns out, defaults on U.S. credit card loans hit the highest level in 14 years last year. You can see this spike in the chart below.

According to BankRegData, credit card lenders wrote off $46 billion in delinquent loan balances in the first nine months of 2024. Again, this is the highest amount since around the time the global financial crisis wreaked havoc on economies worldwide. It’s also a 50% increase from the year prior.

This puts the final nail in the coffin of the “strong economy” narrative that President Biden’s handlers and Fed Chair Jerome Powell have been pushing. It’s anything but strong…

After years of Fed’s money printing and inflation, the American consumer’s finances are in worse shape than they’ve been in decades. And now, that reality is catching up with them in a major way.

Too Many Canaries in the Coal Mine

Banks haven’t reported their fourth-quarter numbers yet, but early signs show more and more people are falling behind on their debts. Capital One, the third-largest U.S. credit card lender, said its write-off rate hit 6.1% in November, up from 5.2% last year.

Other major banks like Citibank, JP Morgan Chase, and Bank of America are all reporting massive spikes in delinquencies.

This is bad news for the consumer, but it’s also a big problem for the banks.

Keep in mind, all of this comes at a time when banks are sitting on hundreds of billions in unrealized losses, facing commercial real estate problems, and watching their credit ratings get downgraded left and right (while their shares hover near multi-year lows).

These are all the reasons why the smart money has been fleeing U.S. banks. As I wrote before, Warren Buffett’s Berkshire Hathaway has been systematically pulling out of major banks since early 2020. They’ve completely divested their stakes in Wells Fargo, U.S. Bancorp, JPMorgan Chase, and Goldman Sachs, while drastically reducing their position in Bank of America. And Buffett isn’t alone—Ray Dalio’s Bridgewater Associates and other major investors have been dumping bank stocks en masse.

The upshot is, the banking sector was already buckling under multiple pressures. I’m not saying card defaults will be the final straw, but they’re certainly piling weight onto a camel that’s already struggling to stand.

One last thing…

I’ve recently spoken with a senior banker who has been in the financial industry longer than the Great Financial Crisis. His take is that the surge in credit card defaults isn’t happening in isolation—it’s part of a broader pattern of distress. The American consumer is simply tapped out. That’s why banks are seeing increases in defaults across all types of consumer debt, from auto loans to mortgages to personal loans. This isn’t about financial schemes or out-of-control risk-taking like we saw in 2008—it’s about the brutal reality that American households are struggling to survive.

And that’s what, according to him, makes this situation potentially even more dangerous than the 2007-2008 crisis was.

Regards,

Lau Vegys