“If the American people ever allow private banks to control the issuance of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of all their property until their children will wake up homeless on the continent their fathers conquered.”

– Thomas Jefferson

August 28, 2024 – “You may be a scribbler, Mr. Wiggin,” writes Robert from Houston, “and cannot help ‘talking your book’. But please don’t. ‘The Very First Right’ was trial by jury from Magna Carta. That right is ignored with impunity the world over.”

Robert goes further.

In 1798, the new U.S. Congress passed the Alien and Sedition Acts which raised residency requirements for citizenship from 5 to 14 years, authorized the president to deport “aliens,” and permitted their arrest, imprisonment, and deportation during wartime.

Regarding the “first right,” the Sedition Act made it a crime for American citizens to “print, utter, or publish…any false, scandalous, and malicious writing” about the government… a mere seven years after the Bill of Rights was ratified.

So much for the right to free speech, then, eh?

The Alien and Sedition Acts, we might find ironic during the 2024 election, were specifically directed against a party called the “Democratic-Republicans” – a party favored by new citizens to the United States.

Robert continues with a list of additional rights that are contravened at will. “I can only conclude,” Robert sums up, “the concept of ‘rights’ is a dangerous and deceitful distraction.”

“The barbarians are truly at the gates of American culture and polity in this time,” reads an even more intense response from Steve. “Ritter is one of the voices needed to repel the invaders.”

Steve gives a bit of his own background for context:

I am a Naval Academy graduate and veteran decorated in combat during the recapture of the USS Mayaguez from the Khmer Rouge pirates in what is called the last battle of the Vietnam War. My motivation at the time was the ongoing fight for freedom, for which I was willing to lay down my life.

Freedom of speech, along with the other freedoms guaranteed by our Constitution and Bill of Rights was at the heart of what freedom meant, and means, to me. Ritter’s career appears to exemplify the importance of these freedoms.

What the modern day “barbarians” don’t seem to – or, more accurately, refuse to – understand is the difference in meaning between the words “freedom” and “license.”

License has replaced freedom in much of today’s social and political culture.

The problem with “license” is that it comes with few, if any, boundaries, whether in culture or government/politics. Those in Department of Justice who are trying to prosecute Mr. Ritter are doing it not under law, which is the basis of freedom, but rather the color of law, the basis for license.

License has replaced sanity with respect to the U.S. dollar, too. The dollar being what it is, a symbol of political malfeasance.

We certainly agree that all of our rights are under constant threat, whether from bad legislation, big tech, or elsewhere. Zuckerberg’s mea culpa, yesterday, aside what gives tech execs or politicians special rights regarding our first among equals in the Bill of Rights we don’t know.

As one recent former president who was shot in the earlobe said with a raised fist… we gotta “fight!”

Alas, we also remind ourselves, today and most days, this is a newsletter about financial wealth as much as it is about freedom. As such, we also received several responses asking for us to stay on target. Specifically: what should one do about the continued demise of the dollar?

During his speech in Jackson Hole last week, Fed chair Jerome Powell all but announced a rate cut of .25% or .50% at September’s meeting… and further, insinuated an extended cycle of aggressive cuts at that time.

Historically, the dollar weakens during rate-cutting cycles. Plus, you’ll earn a lower return on the interest you receive on the dollars you hold. So a weakening dollar hits on several levels.

“How do you invest in gold and cryptos – right now – as an alternative to the weakening dollar?” members want to know.

For a response, we turn things over to Andrew Packer who is taking good care of our Grey Swan portfolio, and looks at gold and bitcoin in the context of avoiding the weakening dollar. Enjoy ~~ Addison

The Case for Analog and Digital Gold Now

Andrew Packer, Grey Swan Investment Fraternity

In 2013, Cyprus was desperate for money. It was just the latest domino to fall amid the global crisis that started with the collapse of the U.S. housing market in 2007.

But unlike many countries who simply printed more money, Cyprus sought an international bailout. To get it, there was one unique term that the International Monetary Fund (IMF) and European Central Bank (ECB) wanted the country to implement…

Noting that Cyprus had grown into a banking haven for wealthy Russians looking to preserve their wealth outside their country, the IMF and ECB asked Cyprus to impose a one-time levy on all uninsured deposits over €100,000.

This is known as a bail-in. It was needed to get the bigger bail-out. And Cyprus agreed to seizing funds in private bank accounts to get it.

As a result, those with bank accounts in the Eastern Mediterranean island nation learned the hard way what happens when governments get desperate.

An estimated 48% of bank accounts valued at over €100,000 were seized. And the country made international headlines for days as desperate citizens flocked to closed bank branches or quickly emptied ATMs.

Beware the Counterparty

All investing carries risk. Some of those risks are obvious. If you buy a stock, it can go to zero. But, if you buy a stock and your brokerage goes under, you can also face substantial losses. You may not have access to your account for weeks, until another company can acquire the account.

This kind of risk isn’t thought of too often. It’s known as the counterparty risk.

In today’s hyper-connected age, your wealth is spread among a number of counterparties.

That can include your bank, your brokerage, your company’s 401(k) provider, even whoever holds your mortgage or anywhere else you may have wealth.

All assets held with a counterparty have some risk.

In the early days of bitcoin, the industry-leading Mt. Gox exchange simply took off with most of their customer’s bitcoin. Today, much of it has been recovered. But those who didn’t have access to their bitcoin for nearly 10 years were unable to move it to cold storage or sell it.

But it’s not just a risk with cryptocurrencies, as the Cyprus bail-in demonstrates.

Today, we’ll look at two practical ways to avoid counterparty risk. You can’t completely protect against it if you want to own assets like stocks or operate your checking account. But you can create a counterparty-free pool of investments. Let’s start with the original one.

The Original Counterparty-Free Investment

For thousands of years, gold has stood free of counterparties. A gold coin held in your possession can be easily exchanged, thanks to its standard unit of weight.

While gold isn’t used for monetary transactions today, modern central bankers haven’t gotten the memo. They’re substantial buyers of the metal. Why? Counterparty risk.

These banks need to own ample reserves for any scenario. Historically, that’s included the currencies of other countries. Having these reserves can ensure the smooth functioning of bilateral trade.

However, since 2020, the world’s money-printing binge has upended this policy. It’s become a question of which country has printed too much, which country has too much debt, or which country is likely to make a sudden devaluation of its currency next.

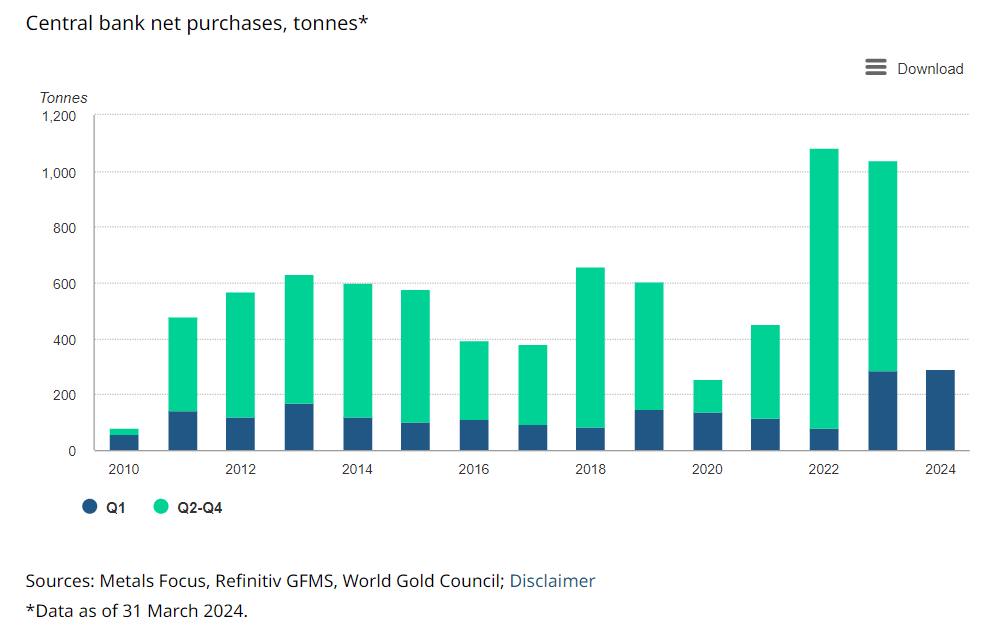

In this increasingly unstable environment for fiat currencies, gold is the logical solution. The World Gold Council noted that central bank buying of gold hit 290 tonnes in the first quarter of 2024 – the strongest start to any year on record.

That’s on top of the surge in buying in 2022 and 2023.

As Addison has noted in recent essays, the metal continues to trend higher, even as stocks have taken a breather. Investor demand remains strong for the metal. And new supplies? They’re not growing enough to meet demand.

Gold is a counterparty-free asset worth buying. You can buy it online, or for the best deal, pay cash at your local coin dealer.

Let’s turn to another potential counterparty-free asset that could be worth buying now.

The Case for Digital Gold

I’ll admit it. When I first heard about the idea of a digital money called bitcoin in early 2009, I was skeptical. I probably wouldn’t have even heard of it that early if it wasn’t for starting in the alternative financial publishing space at the same time.

Bitcoin didn’t really hit my radar in a big way until the Cyprus bail-in. In a two-month period following that incident, bitcoin went from under $40 to $95, surging 350% in just a few months.

Bitcoin prices showed robust strength following the Cyprus bank bail-in program.

That’s where bitcoin proved itself. As a permissionless system operating independently of a government, bitcoin doesn’t get hit with a bail-in. Of course, when the price is dumping, there’s no bail-out either. Pick your pain.

Unlike gold, bitcoin isn’t a central bank asset. But it’s shown, despite some sharp drops along the way, that it can provide some incredible returns. And bitcoin’s surging price is sometimes boosted along the way with data on inflation and other signs of weakness with the fiat monetary system.

Plus, we can always find more gold, even if we have to send robots to asteroids to do so. While bitcoin is currently “mined” by solving cryptographic equations, the last bitcoin will be mined in 2140. Over 93% of all bitcoin has been mined already. That makes bitcoin the hardest asset we know about yet. And it’s why a small allocation to bitcoin may be prudent today.

In 2013, it was difficult to directly acquire bitcoin. Mining was reaching a point where using your computer wouldn’t cut it. And you’d have to buy on an exchange like Mt. Gox – the biggest counterparty risk the space has seen.

Today, part of bitcoin’s value is that it’s easier to acquire. You can open a Coinbase account and get started quickly. Or you can buy with several bitcoin-only platforms, such as Strike, or Swan bitcoin. Several platforms offer dollar-cost-averaging tools to help you get started without going “all-in” at once.

But even then, you’re still carrying counterparty risk. If you “buy” bitcoin on some platforms like PayPal, you can’t even move that bitcoin to a digital wallet. You’re just tracking the price of bitcoin rather than owning it.

To own your bitcoin, you have to get comfortable with a hardware wallet. That’s simply a secure platform where you store your bitcoin data until you want to move it.

Ledger and Trezor are the two largest and most trusted providers for digital wallet hardware (I use both). And as with your gold, you’ll want to keep your hardware wallet somewhere safe.

Owning some bitcoin gives you strong inflation protection and can be free from counterparty risk as with gold.

Counterparty risk may not seem like a big risk. But it’s likely an understated risk and a very real threat as fiat systems destabilize. ~~ Andrew Packer, Grey Swan Investment Fraternity

So it goes,

Addison Wiggin

Founder, The Wiggin Sessions

P.S.“Kudos for publishing in the Grey Swan letter and what most other ‘news’ or ‘opinion’ journals, not to mention the far majority of cable media, would not want to even mention.” ~~ Steve L.

“It may not be helpful to others for me to give you accolades for your positions. But I can and do nonetheless – even at my own peril. Do not put down the pen or the microphone or the camera! Somehow some ways God will bless you, a purveyor of truth. Thanks.” ~ Dick B.

Andrew and the rest of our unique and opinionated fraternity contributors keep a close eye on these asset classes, and can help you with any questions you might have. After today, please send any additional questions you may have about gold and bitcoin, or any comments you have on rights, to addison@greyswanfraternity.com.