Q: What happens when you close down most public spaces, give everyone $1,200, and only leave the stock market open?

A: You turn Wall Street into a giant casino.

One of the fascinating cross-currents of the pandemic era was seeing that experiment play out in real time.

For millions who could work remotely, the extra $1,200 was like getting capital to buy lottery tickets.

That money went into stocks like GameStop, as well as many SPAC firms – shell companies looking to take small, high-growth opportunities public.

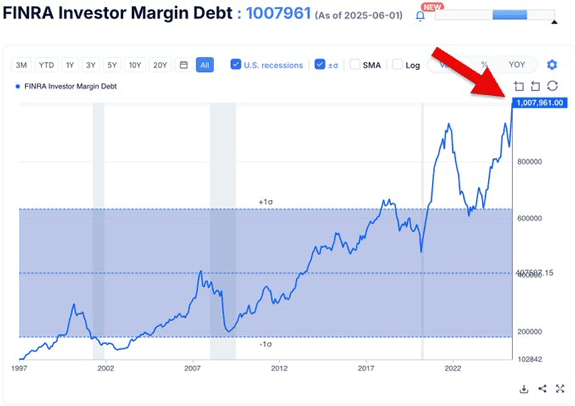

By the time the mania peaked in late 2021, margin debt was at an all-time high as institutional money raced to catch up with retail investors.

But new all-time high margin debt is back today:

Margin debt is now back above its 2021 peak

We had a bear market in 2022, as rising interest rates sucked marginal capital out of the market.

Along the way, we saw that many investment opportunities of the time were simply one buyer getting in ahead of the next buyer…. in search of the “greatest fool” who bought last.

~ Addison

P.S. Given the resurgence in “meme stocks” the past few weeks – Opendoor, Kohl’s – it may be a sign of market froth. And it may take a 5-10% pullback to get some sanity back in the markets.

If you’re leveraged in this market. Don’t be. You’re in a crowded trade. When a trade is crowded, getting to the exit first is on everyone’s mind. Panic now and avoid the rush.

As always, your reader feedback is welcome: feedback@greyswanfraternity.