Over the past five days, while the mainstream financial press has suddenly discovered a new passion for “bubble characteristics” in AI stocks, the three major indices have traded sideways — each losing about 1%.

Bitcoin, meanwhile, suffered a remarkable sell-off following another round of Trump trade puffery, this time regarding soybean oil.

Gold and silver, in the same stretch, have each rallied — 7% and 13%, respectively. From a technical perspective, gold is looking like it may consolidate around $4,20o. But… it’s well-positioned to spike higher.

Let’s start at the beginning.

Stocks down, gold and silver up… what’s happening?

It turns out: a lot.

💵 The Pulse of a Fast World

With social media, 24/7 markets, and an activist president in the White House, a lot can happen in a short amount of time. That may sound like an obvious statement, but it speaks to our purpose here at Grey Swan.

We exist to understand the big trends moving beneath the headlines — while they’re still moving. The goal isn’t to react to noise, but to see the signal. To be positioned well enough that you don’t have to watch the tape every minute of the day.

Today’s a fitting example. We’re releasing our new research feature: “Dollar 2.0: The Final Countdown.” You can view it right here. Our team has done a tremendous job distilling the story of how the U.S. monetary system is being quietly rebuilt — and what that means for investors like you.

When confidence cracks, money starts running downhill.

Capital doesn’t vanish, per se. It retreats.

💰📉 Exter’s Pyramid Explains The Trade

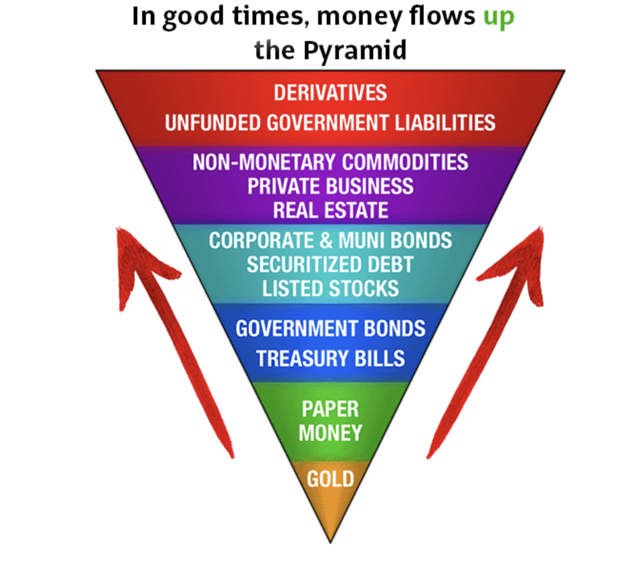

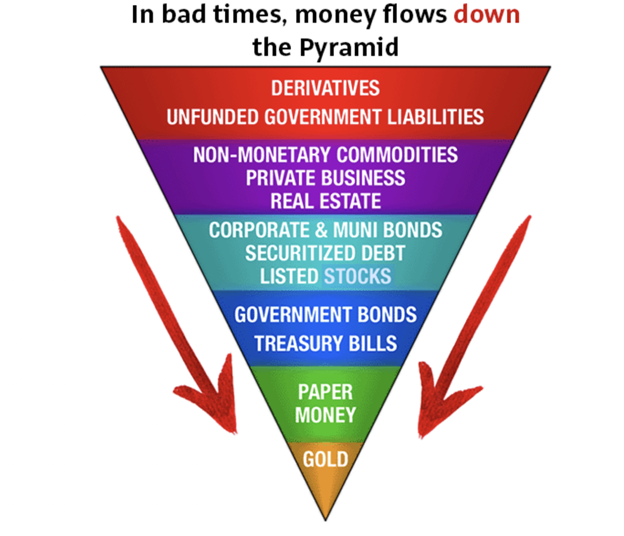

The financial system is built on layers of risk — from derivatives and debt at the top to hard assets like gold and silver at the bottom. When trust fades, capital slides down that slope, away from complexity and toward simplicity.

Hard asset traders have had a bead on how the financial system operates since the early days of the Bretton Woods system. John Exter posited his pyramid while serving as Central Bank of Ceylon’s founding governor between 1950 and 1953. (Source: Silver Bullion)

Exter’s Pyramid, conceived by economist John Exter, maps the hierarchy of risk and liquidity in modern finance. At the narrow bottom sit the most liquid and trusted forms of value — cash, gold, and silver. At the wide, top-heavy peak: leveraged speculation, synthetic assets, and debt-based instruments built on faith alone.

When markets shake, the pyramid flips in motion. Derivatives are dumped, bonds sold, equities questioned, and the flow of capital rushes downward — toward what can still be held.

The cyclical trade of confidence in complex modern financial markets has embraced a much-needed era of simplicity. Trust in markets is only confounded during bubble periods for tech stocks like AI. The digital dollar and 1:1 pairing of digital assets with U.S. Treasurys will give the dollar hegemony several decades of runway. The alternative is the collapse of the global financial system. Caveat emptor. (Source: Silver Bullion)

Risk moves from the complex to the simple, from paper wealth to things you can actually touch. Cash first. Then gold. Then silver.

And lately, the rush to that bottom tier has been gaining speed.

💵🦋 The Dollar’s New Skin

Driven by the unsustainable national debt, policy is supporting a weaker dollar and a move to more viscosity. As in all eras, the national debt needs to be financed with lower interest rates and a weaker currency.

Those are the negative headlines. But what’s unique this time around is the opportunity to digitize dollar assets. It’s only going to happen once.

The dollar isn’t dying; it’s transforming, migrating online. After years of institutional and political headwinds, Trump’s team is monetizing the debt using new technology not previously deployed… and actively blocked by all prior policy.

A fundamental upgrade to the monetary system is underway — one that merges traditional finance with digital infrastructure. Treasury regulations rolling out next week will accelerate that process. As you’ll see on our presentation, there’s a unique one-off meeting happening on October 21, and we expect to set in motion the “final countdown.”

The U.S. dollar and U.S. Treasurys are getting hardcoded into the new digital asset system.

“The tokenization of all assets has begun,” said Larry Fink, BlackRock’s CEO, not as a prediction but as an observation. Banks, fintechs, and blockchain firms are now competing to build the rails of the future — the channels through which every form of capital will flow.

We’re entering a moment when the architecture of money itself is being replaced, layer by layer, while most investors still think they’re trading stocks and bonds in the same system as before.

🪙 The $20 Trillion Migration

As we outline in our presentation, up to $20 trillion in assets could migrate into these new digital networks over the next five years — a shift comparable only to the invention of the Internet. Bonds, payments, custody services, commodities — all of them are being reengineered to settle faster, cheaper, and with less friction.

The opportunity isn’t in trading digital coins. It’s in understanding the new infrastructure of trust that’s being built beneath them.

📊 When Trust Fades, Reality Returns

Back to Exter’s Pyramid. In periods of expansion, money climbs the pyramid, seeking yield in leverage, speculation, and abstraction. But when trust fades — whether because of tariffs, trade wars, or technological confusion — it reverses course.

That’s what you’re seeing now. The AI trade that looked unstoppable a month ago has gone soft at the edges. The dollar’s brief rally feels brittle. Bitcoin’s volatility reminds us how faith-based new money still is. And quietly, the timeless refuges — gold and silver — are catching a bid.

They’re not symbols of “fear” exactly. They’re monetary muscle memory.

🎯 Position, Don’t Chase

That’s why we’re focused on forecasting and positioning — not prediction. The world is moving fast. Markets are emotional. Policy is reactive. But understanding the structure — of money, of confidence, of capital — lets you move with the current, not against it.

Gold at $4,200 isn’t a mania. Silver above $50 isn’t panic. They’re the visible signs of invisible motion — the weight of trust sliding down the pyramid.

🌊 The Final Countdown

Today, we’ll unpack all of this in Grey Swan Live!: “Dollar 2.0 — The Final Countdown.” Ian King joins me to discuss how the financial system’s next phase is being engineered — and how to position yourself before the $20 trillion migration is complete.

Because in a world where trust is the last commodity, understanding where it flows is the ultimate trade.

~ Addison

P.S. Our special focus Grey Swan Live! just dropped. Don’t miss your deep dive into Dollar 2.0: The Final Countdown — what’s coming, who wins, and how you can stay ahead of the fastest monetary transformation in modern history.