Lau Vegys, Doug Casey’s Crisis Investing

You might not have noticed it, but amid the election circus, Thanksgiving feasts, and the fast-approaching holiday season, something really interesting has been happening behind the scenes. Warren Buffett, the legendary investor, has been steadily pulling his money out of banks—and not in a small way.

Since July, Buffett’s holding company, Berkshire Hathaway, has sold 260 million shares of Bank of America (BofA), cashing out over $10 billion. This rapid-fire selling has reduced Berkshire’s stake to under 10%. That means Buffett can keep selling without having to disclose it right away.

But the Oracle of Omaha’s banking exodus extends far beyond Bank of America. Since early 2020, Buffett has systematically pulled his investments out of Wells Fargo, U.S. Bancorp, JPMorgan Chase, and Goldman Sachs—completely divesting Berkshire’s stakes in each of these financial giants.

And Buffett isn’t the only one making these moves. Ray Dalio’s Bridgewater Associates and other major investors have also been dumping bank stocks en masse.

So why are these financial heavyweights suddenly fleeing the banking sector like rats from a sinking ship? Believe it or not, they’ve got a good reason.

A Ticking Time Bomb

Earlier this year, there was this massive study published from Klaros Group, a consulting firm, and it found that 282 regional banks have both high levels of commercial real estate exposure and large unrealized losses from the rate surge.

That’s the same toxic double whammy that pushed First Republic and Signature Banks over the edge last year, remember?

These banks went under because they couldn’t raise enough money by unloading their investment portfolios (which were deeply underwater due to the Fed’s rate hikes) to pay back the depositors who were rushing for the exits.

Chances are, it’s not only these 282 banks that are at risk—there are likely many others not covered by the study.

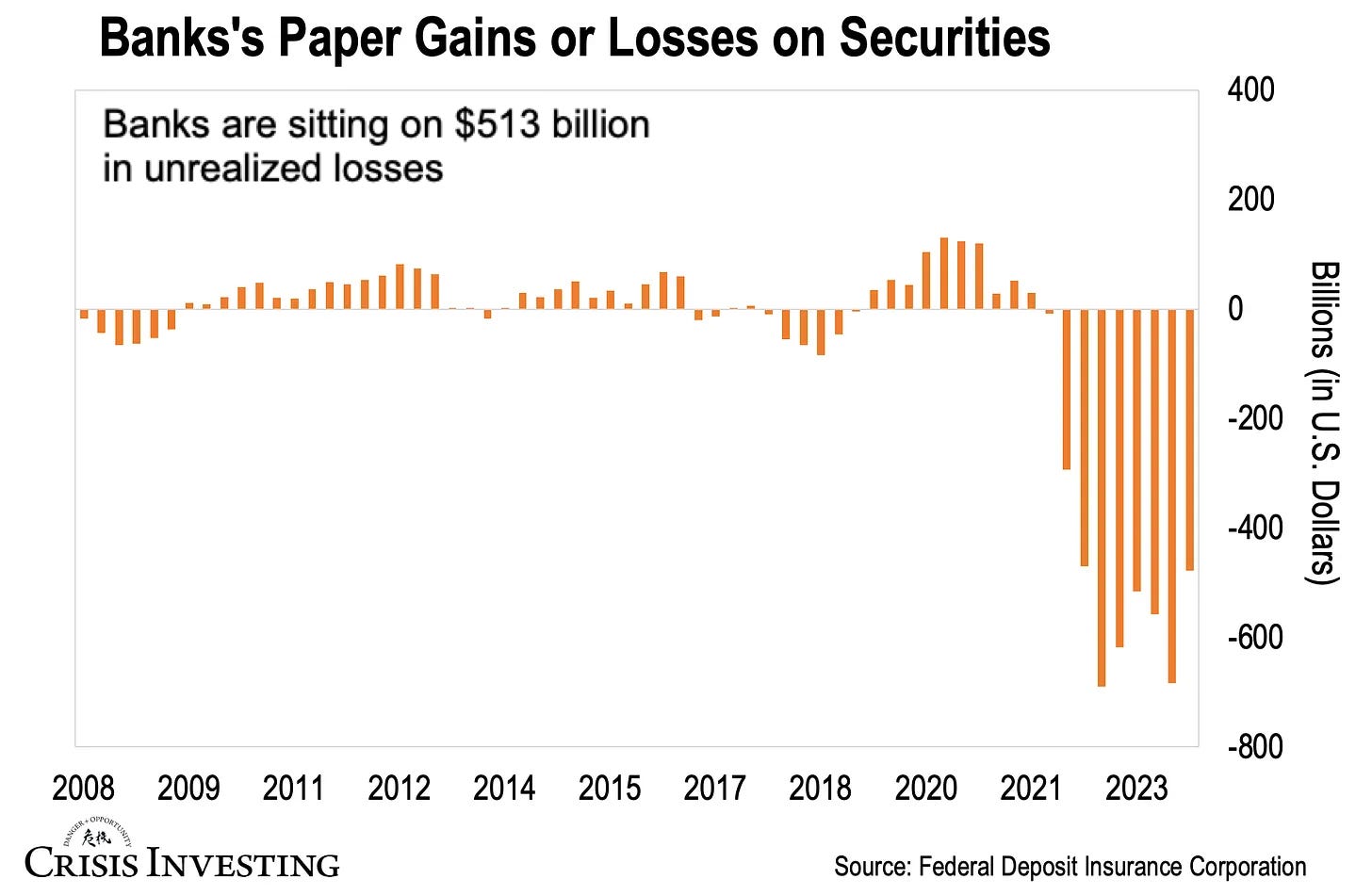

Speculation aside, here’s what we do know for a fact: U.S. banks as a group are currently sitting on $513 billion in unrealized paper losses on securities.

It’s an impressive figure, far surpassing the “paper” losses seen during the 2008 crisis. In other words, the U.S. banking system is operating at a massive loss.

Now, this isn’t necessarily a big problem in normal times. Banks have ways of managing cash flow issues, even when dealing with paper losses. And if they hold the bonds to maturity, those losses never materialize (since the bank receives the full face value and all interest payments).

But these times are anything but normal. The economy is shaky, prices are still soaring, real estate is a mess, and risk assets are back in vogue. All of this has depositors on edge. And when a wave of them rushes to withdraw their money at the same time, the banks have to find a way to pay. That often means selling bonds before they mature, which turns those paper losses into real ones—quickly, and devastatingly.

Between a Rock and a Hard Place

I’m convinced the next bank run is just around the corner. Here’s why.

Let’s revisit Bank of America, which, as you’ll see, is essentially the poster child for this entire problem.

Back in the summer of 2020, they bought more than $500 billion worth of “COVID bonds.” These were long-duration mortgages paying only about 1% a year.

At the time, they probably thought they were the smartest guys in the room. Interest rates had been near zero for years with no signs of rising. And with the Fed pumping liquidity into the system during the pandemic, BofA likely assumed rates would stay low indefinitely.

Fast forward a couple of years, and it turns out they weren’t so smart after all. In fact, they misread the economic tea leaves so badly that they ended up making one of the worst financial blunders in modern history.

Why? Because between March 2022 and July 2023, the Fed cranked the federal funds rate from a rock-bottom 0%-0.25% all the way up to 5.25%-5.50%. You know, to fight inflation—the very thing they created in the first place.

Note: The federal funds rate is the interest rate at which banks lend money to each other overnight. When the Fed raises this rate, borrowing costs across the economy rise, pushing up interest rates, including those on government bonds.

When that happened, the value of BofA’s low-yield bonds plunged, and paper losses quickly piled up, decimating their balance sheet.

As of now, they’re sitting on $89 billion in unrealized losses on those bonds.

This is a huge problem because it’s forcing them to pay depositors a paltry 0.01-0.04% interest.

Offering competitive rates would mean selling those underwater bonds at massive losses, which would completely wreck their balance sheet. So, BofA is stuck between a rock and a hard place—paying meager interest and praying that depositors don’t flee for better yields.

Honestly, it’s astounding that a bank run hasn’t hit BofA already, especially when depositors can easily earn far better returns at other banks or in Treasuries. Once customers realize how little they’re making, a rush for the exits could happen shockingly fast. In our digital age, a few taps on a smartphone could drain BofA’s deposits in a matter of hours.

And it’s only a matter of time before depositors do catch on. You can take that to the bank.

FDIC to the Rescue?

But, again, it’s not just Bank of America, even if it’s the most glaring example. Many other banks are sitting on similar losses, trading at or near their lowest levels in two years, with credit ratings downgraded. This reflects just how little confidence investors have in their operations, and again, soon enough, depositors will figure it out too.

But what about the Federal Deposit Insurance Corporation (FDIC)? If you brought this up at Thanksgiving dinner, you’d probably hear someone say, “I’m not worried—the FDIC will cover me!”

The reality is more complicated. The FDIC fund only has about $385 billion on hand. And as I mentioned earlier, U.S. banks are currently sitting on $513 billion in unrealized losses.

This means the FDIC might need more cash in a major crisis, which, in turn, means the Fed (and the Treasury) will likely have to step in to stabilize the situation.

The Fed knows the problem—more bank runs could mean another big bailout. To avoid that, it seems set on helping banks recover their Treasury bond losses before things get out of hand.

That’s one reason why the Fed has been willing to cut rates twice this year, even with inflation still high and stocks near record highs.

But bank runs can quickly trigger a domino effect of panic. And if that happens, it’ll spill over into the broader economy, no matter what the Fed does.

Regards,

Lau Vegys

P.S. If you’re a BofA depositor, I’d consider pulling your money out—for sound sleep, if nothing else. If you’re more financially savvy, consider betting against their stock. At the very least, look into alternative investments like gold. With the Fed already cutting rates, gold is probably headed for another all-time high soon. And it goes without saying that it would do exceptionally well if we see another bailout.